Business Tax Id Look Up

You must enter a filing number. So every tax ID has a different meaning for business purposes.

Users may file organizing documents and may file documents for existing entities using this system.

Business tax id look up. 25 Pages 50 Pages 100 Pages. Generally businesses need an EIN. First check to see if you received an email or physical letter from the IRS confirming your EIN when you first applied.

The IRS generally sends out a confirmation of your EIN after you applied for one. Business Entity Id. You may apply for an EIN in various ways and now you may apply online.

Best Small Business Loans of 2020 - Get Between 5000 and 500000 How much money does your business need. Other commonly used terms for EIN are Taxpayer Id IRS Number Tax Id. The public may access general information for all entities on file including registered.

Use the File Number assigned by the Texas Secretary of State. Search by Filing Number. The Employer Identification Number EIN also known as the Federal Employer Identification Number FEIN or the Federal Tax Identification Number FTIN is a unique nine-digit number assigned by the Internal Revenue Service IRS format.

Locate contact information for state agencies employees hotlines local offices and more. Search by Identification Number. Look Up EIN For Business-A business is an employer identification number so the business owner can easily use this identification number for any business purpose.

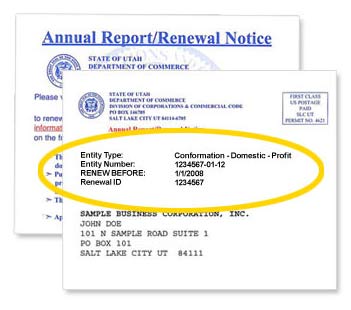

Begins With Exact Match Keyword Soundex. If you have a businesss tax ID number but dont know the name of the business and plugging the number into an Internet search engine doesnt get you the businesss name you may be able find out by using a reverse look-up service such as Search Bug. The businesses registered with the State of Utah are either located in Utah or doing business in Utah as a.

A relationship existing between two or more persons who join to carry on a trade or business. This is a free service offered by the Internal Revenue Service and you can get your EIN immediately. You may apply for an EIN in various ways and now you may apply online.

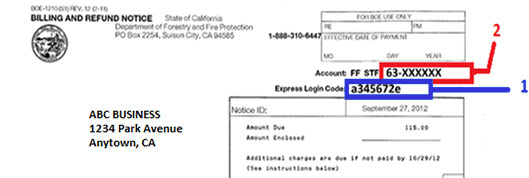

Taxpayers may search by taxpayer number employer identification number EIN legal name business name city and zip code to verify the status active or inactive of a sales and use tax permit. Look for tax and tax-related documents from the IRS both in your email and physical mail. Display number of items to view.

EIN Employer Identification Number An Employer Identification Number EIN is also known as a Federal Tax Identification Number and is used to identify a business entity. Generally businesses need an EIN. San Jose Ca 95113 408 535-3500 - Main 800 735-2922 - TTY.

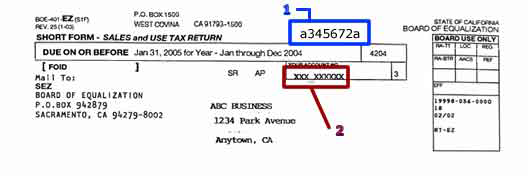

It will be in either your. The entity number is the identification number issued to the entity by the California Secretary of State at the time the entity formed qualified registered or converted in California. Employer Identification Number EIN.

Texas Comptroller of Public Accounts. The Business Entities Online system allows users to file corporate documents online and to search entities on file with the Secretary of States Office. A legal entity that is separate and distinct from its owners.

Business Trust Collection Agency Corporation For Profit and Non Profit Professional Corporation Doing Business As - DBA Limited Liability Company - LLC Limited Liability Partnership - LLP Limited Partnerships - LP Limited Cooperative Associations - LCA. Contact us Report an issue 200 E. Corporations that elect to pass corporate income losses deductions and credits through to their shareholders for federal tax purposes.

This search allows vendors to determine permit status of purchasers before accepting a resale certificate. How to find your business tax ID number. Required Fields Search Criteria.

Search Businesses Registered in North Carolina. XX-XXXXXXXXX to business entities operating in the United States for the purposes of identification and employment tax reporting. Keep in mind though that such services usually charge a fee for each search.

Search Tax ID Use the 11-digit Comptrollers Taxpayer Number or the 9-digit Federal Employers Identification Number. Check your EIN confirmation letter Check other places your EIN could be recorded Call the IRS. Looking up your EIN or tax ID should be simple since theoretically it should be stamped all over your documents.

The ID number must be 6 or 9 digits in length. An Employer Identification Number EIN is also known as a Federal Tax Identification Number and is used to identify a business entity. If searching for a corporation by entity number the letter C must be entered followed by the applicable seven-digit entity number.

Warning Entity IDFiling Number searches are exact match only.

Https Www Oecd Org Tax Automatic Exchange Crs Implementation And Assistance Tax Identification Numbers Indonesia Tin Pdf

How To Find Your German Tax Id Steuer Id Steuernummer And Vat Number All About Berlin

Ein Vs Ssn What S The Difference The Blueprint

Do I Need An Ein Mafia Hairdresser Employer Identification Number Hairdresser Tips

What S A Tax Id Number Business Tax Online Jobs Photography Jobs

Italian Tax Code Codice Fiscale Studio Legale Metta

Letter Ein Confirmation Confirmation Letter Employer Identification Number Doctors Note Template

Form 1099 Nec For Nonemployee Compensation H R Block

Kansas Department Of Revenue Business Tax Home Page

3 Simple Ways To Find A Company S Vat Number Wikihow

Is My Tax Id The Same As My Social

How To Get A Day Care Tax Id Number Employer Identification Number Opening A Bank Account Employment

How To Find Your German Tax Id Steuer Id Steuernummer And Vat Number All About Berlin

What Is A W 9 Tax Form H R Block

Tax Return Fake Tax Return Income Tax Return Income Statement

Obtaining Taxpayer Identification Number Tax Id In Ukraine From 99 Usd Corporate Law Tax Law Firm

Post a Comment for "Business Tax Id Look Up"