Business Tax Id India

Business tax consists of two separate taxes. The legal authority for allotment and use of PAN is derived from Section 139A of the Income-tax Act 1961.

How To Apply For Pan Card For Your Business Drip Capital

28 rows The last 2 digits are for the type of tax that is being collected 03 represents.

Business tax id india. This includes businesses with a physical location in the state as well as out-of-state businesses performing certain activities in the state. Whether youre a large multinational company a small business owner or a self-employed individual this site contains all the resources youll need to properly file your return. Mergers Acquisitions in India.

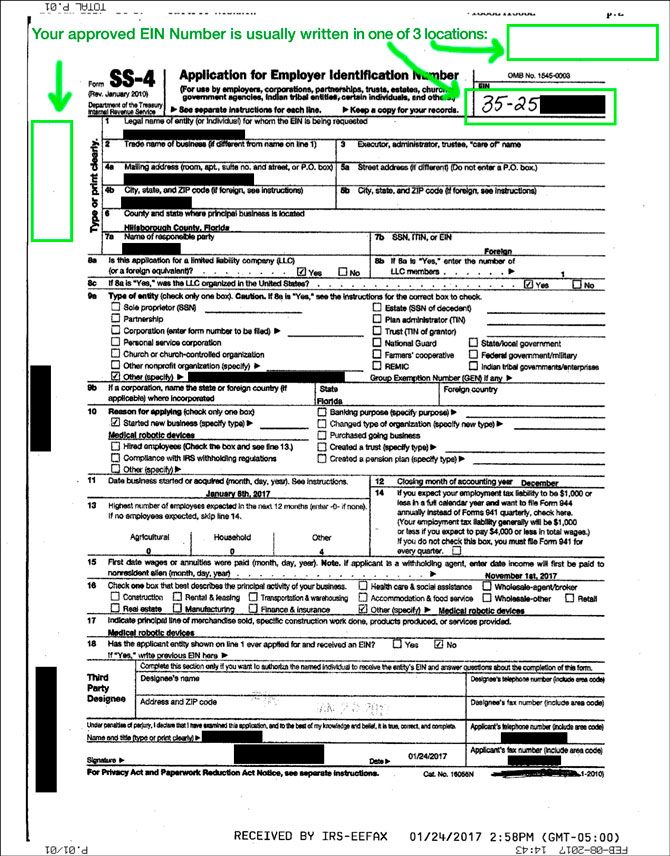

6 In addition to being used for paying business income taxes an Employer ID is used. The rate of tax levied varies from city to city in India and is generally related to the prevailing market prices for property in each locality. Verify and locate Tax IDs instantly.

Like Permanent Account Number or PAN is an identification number for individual taxpayers similarly TIN is an identification number assigned to business enterprises for tracking their transactions. Although its labeled as an identifier for employers you dont have to have employees to need an EIN. Malibu CA 90265 USA.

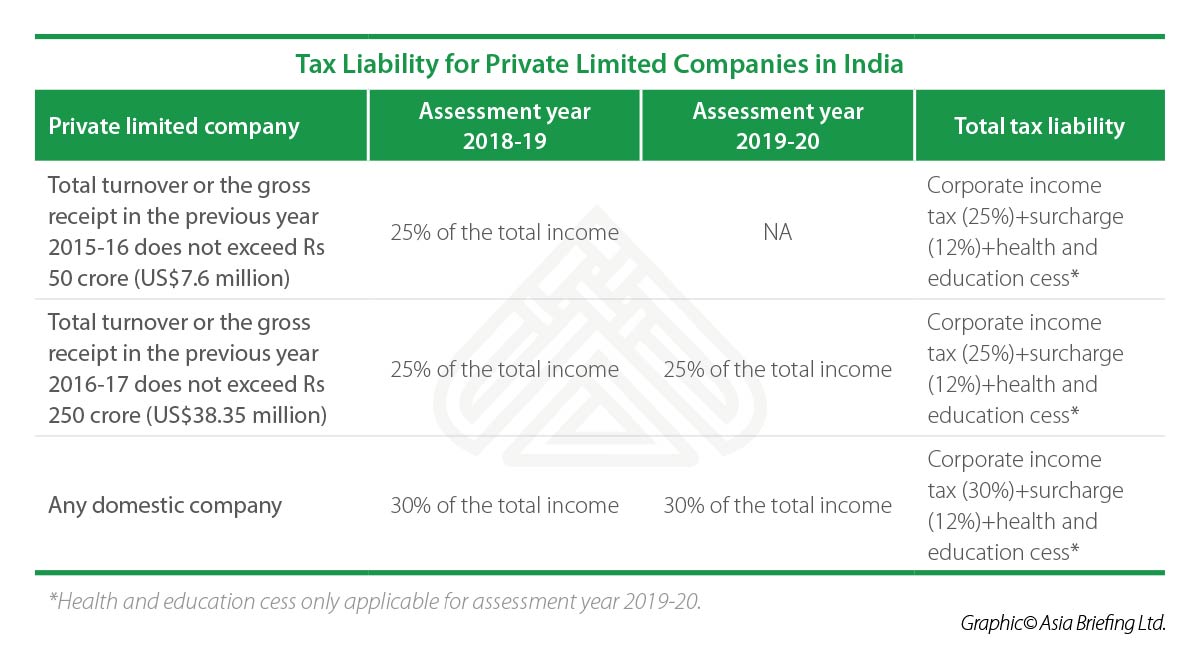

Review income tax corporate tax GST and more and get a sense of which taxes might apply in your situation. If you are opening a business or other entity that will have employees will operate as a Corporation or Partnership is required to file any of. You may also need to complete the FT-1 application for motor fuel taxes including special fuel or transporter taxes or the AVF-1 application for aviation fuel excise tax.

Tin is basically required for all entities that are. Search over millions of EINs online. Like all individuals earning income are supposed to pay a tax on their income business houses too are supposed to pay as tax a certain portion of their income earned.

To begin your application select the type of organization or entity you are attempting to obtain a Tax ID EIN Number in Indiana for. Learn why the government has different taxes for certain activities or types of income. In Indian reporting context when one has to report foreign income or assets the person has to quote the TIN or equivalent number issued by the corresponding tax jurisdiction.

Corporate Tax in India Corporate tax in India is levied on both domestic as well as foreign companies. By banks as a requirement for opening a business bank account. To register for Indiana business taxes please complete the Business Tax Application.

Travelling to India on business. In a foreign country like the US there is a TIN. This tax is known as corporate tax corporation tax or company tax.

Business Taxes in India. The state business tax and the city business tax. With a few exceptions all businesses that sell goods or services must pay the state business tax.

India Information on Tax Identification Numbers Section I TIN Description In India TIN is officially called Permanent Account Number PAN. An Employer ID or EIN is a federal tax identification number for businesses. Stamp duty is a government tax that is levied on all legal property transactions.

If you work in or have business income from Indiana youll likely need to file a tax return with us. 38 rows A TIN typically contains 11 characters and is provided by the IT department to all the business entities willing to register under VAT or CST. So it is a similar or rather a comparable identification number.

Federal Tax ID Number Search Experts. After completing the application you will receive your Tax ID EIN Number via e-mail. Apply for a Indiana Tax ID EIN Number Online.

Look at the nine most common taxes small business owners should understand before they launch their new businesses. Property tax is levied by the governing authority of the jurisdiction in which the property is located. View EIN for India.

Corporate Identification Number Or Company Cin No In India Lopol Org

How To Register Your Blogging Company Inn India Sole Proprietorship Business Blog Small Business Online

What Is Corporate Tax And Corporate Tax Rate In India

Indian Income Tax Taxpayer Services Identified For E Delivery Accounting Taxation Income Tax Tax Payment Income

India E Pan Card Template In Psd Format Income Tax Department Fully Editable With All Fonts Id Card Template Card Template Templates

Pan Stands For A Permanent Account Number That Is An Identification Number Issued By The Income Tax Department To All Taxpayers In India Cards Income Tax Pan

Uses Of Pan Card Know The Advantages Importance Of Pan Card India 2021

How To Check If Your Pan Card Is Active Or Not Credit Card Statement Active One Time Password

Work From Home By India Tax Starting Your Own Business Tax Working From Home

Evc Is The New Way Of Verifying Income Tax Returns Introduced By The Government This Tax Season Now Income Tax Returns Tax Refund Income Tax Return Income Tax

What Are The Documents Required For Llp Registration In India In 2020 Income Tax Return Filing Income Tax Return Tax Return

Do You Want To Apply For Pan Card It Is Issued By The Indian Income Tax Department Which Is Unique To Every Taxpayer Holder You Aadhar Card Cards Accounting

Taxpayer Identification Number How To Apply Are You The One Social Security Card

How To Apply For Pan Card Online How To Apply Luxury Business Cards Aadhar Card

Decoded Your Pan Card Number Has Deep Meaning Unique Identity Check How It Is Formed Zee Business

Filing Income Tax Return India By India Tax Income Tax Return Income Tax Tax Return

How To Set Up A Private Limited Company In India India Briefing News

How To Apply For Ein For Your Llc Without An Ssn Or Itin Llc University

Post a Comment for "Business Tax Id India"