Ppp Loan First Year Business

Operate business in US or Canada have a business bank account 560 personal credit score. 1 day agoTampa business owner explains how the PPP loan saved her livelihood.

Paycheck Protection Program How It Works Funding Circle

The Small Business Association has.

Ppp loan first year business. And these cases are just the beginning. Prospective borrowers can apply for up to 150000 in loan funds that will be repaid over 30 years. Second Draw PPP loans can be used to help fund payroll costs including benefits.

PPP now allows certain eligible borrowers that previously received a PPP loan to apply for a Second Draw PPP loan with the same general loan terms as their First Draw PPP loan. Employee and compensation levels are maintained. First draw PPP loans may have been taken during the first round if the business took a PPP loan in 2020.

Your business was operational before February 15 2020 Your business is still open and operational. Submit one simple application to potentially get offers from a network of over 300 legit business. Funds can also be used to pay for mortgage interest rent utilities worker protection costs related to COVID-19.

Depending on when your business was established you may still qualify for a PPP loan. Tampa Business Owner Explains How PPP Loan. The PPP is a loan program that provides government-guaranteed forgivable loans for qualifying small businesses to maintain their payrolls and pay other qualifying business expenses meaning that if you use the loan funds as directed and follow all other program requirements you wont need to pay the loan.

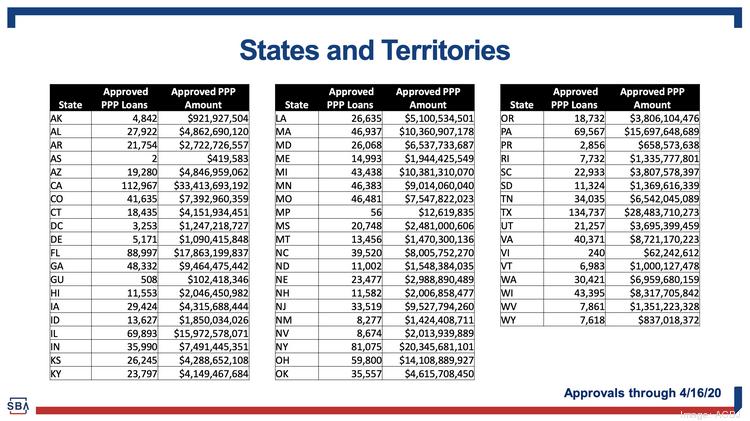

For most businesses PPP loan amounts are calculated based on average payroll costs over the past year. Florida received more than 32 billion dollars from the PPP to distribute to businesses across the Sunshine State. First draw PPP loans If the following statements apply to your business you are eligible to apply for your first PPP loan in 2021.

First Draw PPP loans can be used to help fund payroll costs including benefits and may also be used to pay for mortgage interest rent utilities worker protection costs related to COVID-19 uninsured property damage costs caused by looting or vandalism during 2020 and certain supplier. You should exclude from your calculation of average monthly payroll costs any compensation in excess of 100000 per employee which comes out to 15385 per individual. However due to the nature of your new business you can calculate your loan amount based.

The loans bear an interest rate of 375 for companies and 275 for non-profit organizations. This was the fourth highest amount granted. Then President Donald Trump blocked business owners from claiming deductions for business expenses paid with PPP money.

The maximum amount of money you can borrow through the PPP is equal to 25 times your average monthly payroll costs or 10 million whichever is lower. I was very grateful for the first PPP loan Renee said. When Congress passed the second coronavirus.

The EAA reopens the loan program for first-time borrowers those who have never taken a PPP loan before known as a first draw and creates a new provision for second-time borrowers who are taking a second draw from PPP funding. 2 Documentation including IRS forms must be supplied for the selected reference period. Lendio business loans.

The loan proceeds are spent on payroll costs and other eligible expenses. Eight On Your Side first spoke to her over a year ago when the pandemic started and. Your business must have been in operation as of February 15 2020 in order to apply for a PPP loan.

Costs from either calendar year 2019 or calendar year 2020 for their First Draw PPP Loan amount calculation. PPP is a loan designed to provide a direct incentive for small businesses to keep their workers on payroll. The Justice Department has brought criminal charges against at least 209 individuals in 119 cases related to Paycheck Protection Program PPP fraud since banks and other lenders began processing loan applications on behalf of the Small Business Administration on April 3 2020.

18 hours agoWhile the deadline to apply for a PPP loan has passed there are still financial resources available for small business owners. First Draw PPP loans made to eligible borrowers qualify for full loan forgiveness if during the 8- to 24-week covered period following loan disbursement. At least 60 of the proceeds are spent on payroll costs.

Typically a forgiven loan is considered taxable income but Congress as part of the first pandemic rescue package last spring decided PPP loans should be considered tax-free. The first payment is deferred for one year.

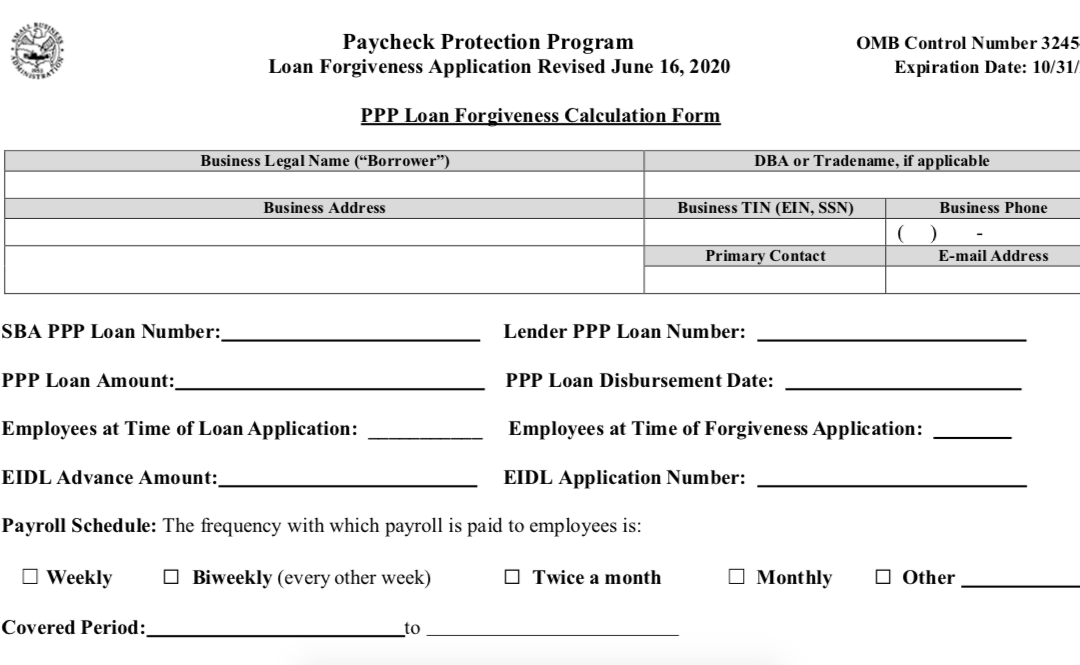

Ppp Loan Forgiveness Everything You Need To Know Bnc Tax

Final Numbers Are In From The First Round Of Ppp Loan Numbers See What Kansas Businesses Received Wichita Business Journal

Paycheck Protection Program How It Works Funding Circle

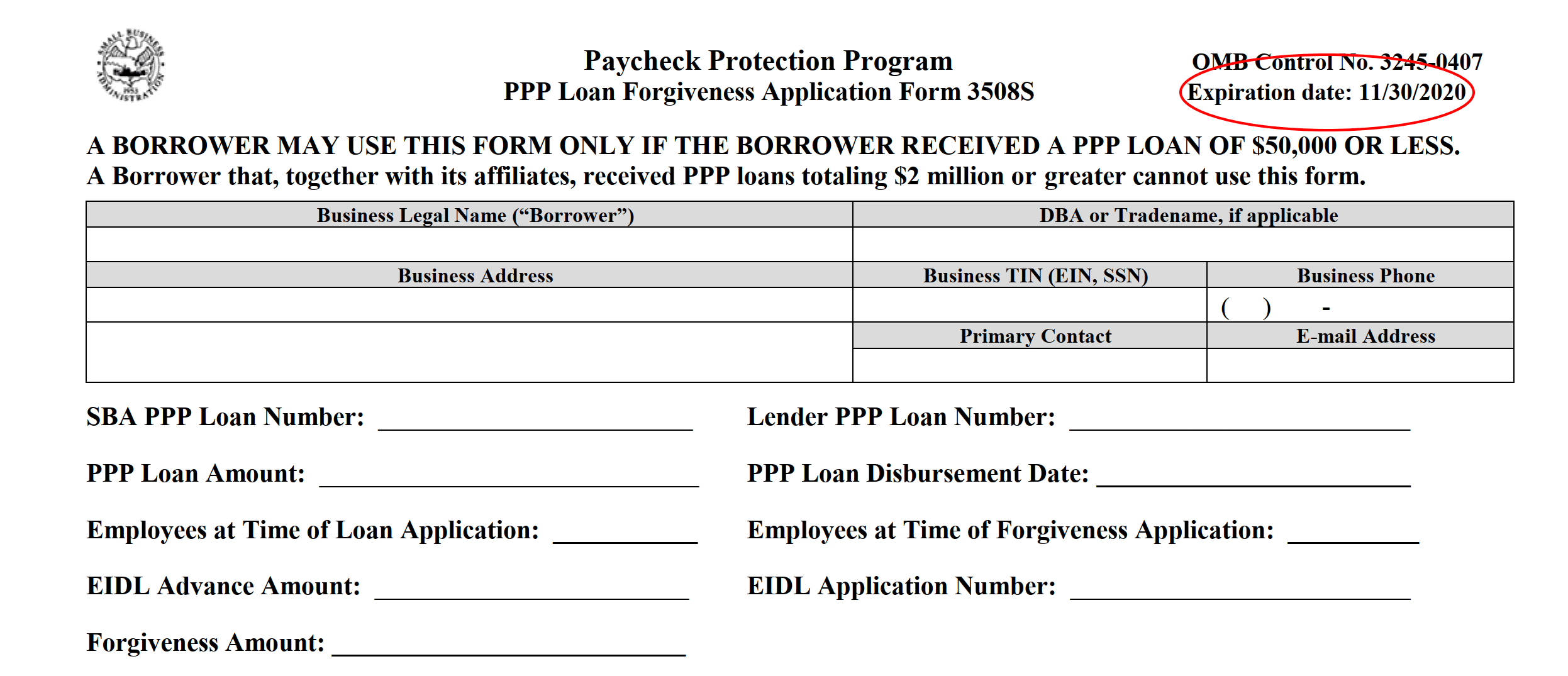

Sba Easing Forgiveness Of Paycheck Protection Program Loans Of 50 000 Or Less Loan Forgiveness Loan Paycheck

Providers Can Now Get More Money From The Ppp Tom Copeland S Taking Care Of Business

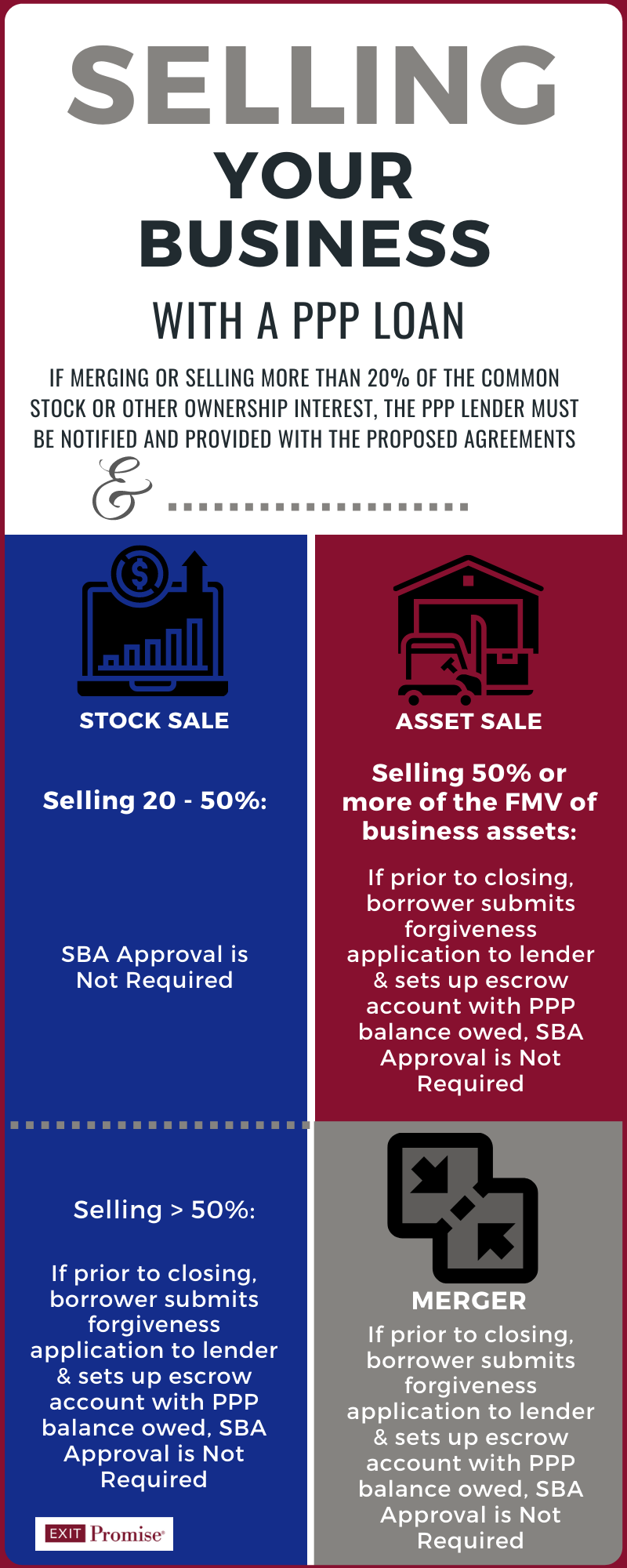

Ppp Loan When Selling A Business Exit Promise

Pin On Paycheck Protection Program

Paycheck Protection Program Loan Forgiveness Becu

Top Ppp Loan Lenders Updated Approved Banks Providers

Sba Clarifies Filing Date S For Ppp Loan Forgiveness Gyf

How To Calculate Your Ppp Loan Amount Bluevine

Post a Comment for "Ppp Loan First Year Business"