Business Definition As Per Gst

A business asset is something used for your business for example manufacturing equipment a delivery van or office computer. From the above definition it can be noted that.

Gst Registration Flow Chart Registration Flow Chart Registration Form

Kindly provide some clarity on this issue at the earliest.

Business definition as per gst. You generally incur a GST liability when you sell a business asset. Definition of Business Entity - GST Suresh yadav Student CA IPC IPCC 13 September 2017 Definition of Business Entity Advocate service received by unregistered Business entity. Supply or acquisition of goods including capital goods and services.

As per schedule I to CGST Act 2017 activities as mentioned below shall be treated as supply even if made without consideration. 20062012 reciever of service is requuired to pay service tax at prescribed percentage when certain services like manpower supply security service works contract rent-a-cab etc. The house may be on land owned or leased by that builder.

Provisions relating to taxability of such services under GST. Pre-condition for a supply to be called a supply as per GST. GST and floating a company.

Taxable event under GST arises when a person undertakes Supply of goods or services. Rules for specific transactions. Activities are undertaken by CG SG or any Local authority.

As per Notification 302012 dtd. What is the meaning of Additional place of. The amendment bought in the definition is that principal place of the business will be the place mentioned in registration certificate irrespective of the location of books and accounts.

The term builder may also include. Services supplied as the holder of the office. GST-events and conferences supplied by non-residents.

When under any act specific word is not defined as per. Provision of facilities to a member of a club association etc. Principal place of business means the place of business specified as the principal place of business in.

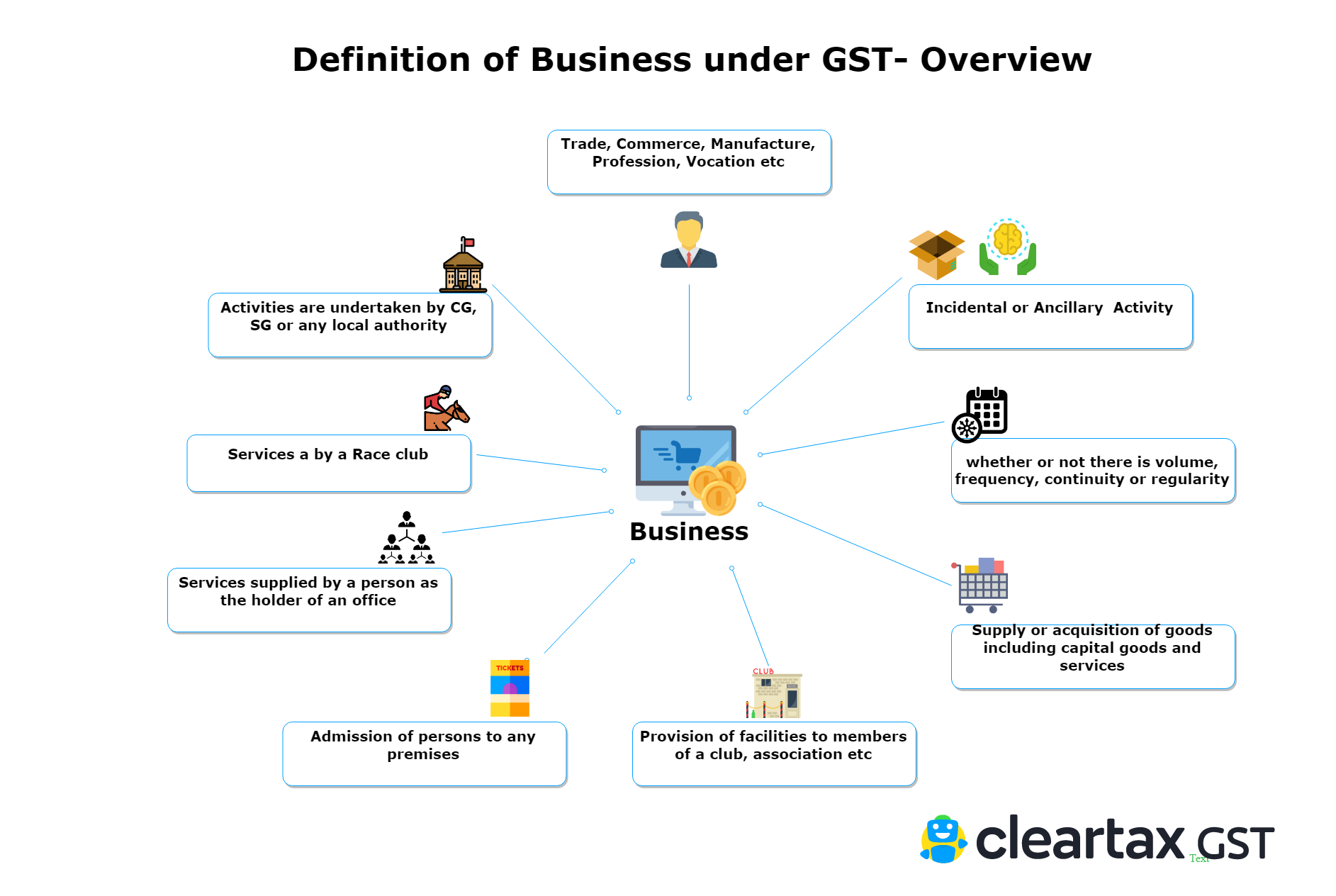

Definition of Business under GST- Overview. Definition of Body CorporateBusiness corporate Service Tax. Explanation- Any activity or transaction undertaken by the Central Government a State Government or any local authority in which they are engaged as public authorities shall be deemed to be business When this definition given in revised GST law is compared with old definition given in model GST law it can be noted that a new explanation is added in the clause aiming to cover.

Meaning a single transaction of supply also is considered business Also occasional trade or even one time trade constitutes business. Admission of person to any premises. As per Section 244 of CGST Act 2017 e-commerce has been defined as supply of goods or service or both including digital products over a digital or electronic networkWhereas as per 245 of CGST Act 2017 an e-commerce operator has been defined as any person who directly or indirectly owns operates or manages digital or electronic.

Agent consignment and progressive transactions. Builder for the purposes of GSTHST rebates generally includes a person who is in the business of constructing or substantially renovating houses for sale. Intangible items such as goodwill may also be business assets.

GST on sales of Australian accommodation by offshore sellers. Goods that are a part of the business assets carried on by the taxable person is deemed to be supplied by himher before the person ceases to be taxable. Definition of E-Commerce as per GST Laws.

GST - Hire purchase and leasing. 2 77 Principal place of business. As per Education Guide on CBEC website the term business entity includes proprietors individuals but as per the definition given in Section 65 b19 of the Finance Act 1994 the term business entity doesnt cover individuals.

The principal place of business is generally the address where the businesss books of accounts and records are kept and is often where the head of the firm or at least top management is located. Permanent transfer or disposal of business assets where input tax credit has been availed on such assets. To consider the activity as Supply it has to satisfy business test specified under Section 217 of the CGST Act and also definition of Supply provided under Section 7 of the CGST Act.

The new definition reads as follows. GST - Definition of Principal place of business Proper Officer and Services. Tax Implication Under GST Itemized Sale of Assets.

GST - Agent consignment and progressive transactions. As per GST authorities in India Principal Place of Business is the primary location within the State where a taxpayers business is performed. Is provided by a proprietorship partner ship society to a.

Definition Of Business Under GST Overview. Business includes any activity carried out by a person whether or not there is volume frequency continuity or regularity of such transaction. A manufacturer or vendor of a new mobile home or floating home.

Taking further to our discussion we are continuing our discussion the definitions given under Section 2 of revised GST law and comparing the same with old model GST law to know the changes made in revised law-. As per the provisions mentioned above under GST the transfer of business assets is considered a supply.

Gst Rate On Sale Of Scrap Materials With Hsn Code Sag Infotech Scrap Material Coding Material

Gst Return Filing Procedure Types Of Gst Returns Due Date And Penalty Indirect Tax Goods And Services Goods And Service Tax

What Is Capital Assets Income Tax Capital Assets What Is Capital

Applicability Of Gst On Online Business Or Services

Supply Under Gst Definition Meaning Scope Of Taxable Supply

Pin By Rajesh Doye On Gst India Goods And Services Tax Goods And Services Goods And Service Tax Indirect Tax

Pin By Tax4 Wealth On Gst August Credit Account Filer

Everything You Should Know About Gst Emergeapp

Know About Types Of Gst Returns And File Your Return Under The Desired Categoriy Timely Timley Gst Return Filing Gi Credit Card Design Card Design Credit Card

Purchase Order Format As Per Gst The Cheapest Way To Earn Your Free Ticket To Purchase Orde In 2021 Invoice Format Invoice Format In Excel Invoice Template

As Per Official Blog Of Tally Solution Company Soon Company Is Updating Release 6 Of Tally Erp Accounting Education Essay Outline Template Accounting Notes

Best Gst Registration At Kolkata Business Insurance Professional Liability Income Tax Return

Everything You Should Know About Gst Emergeapp

Gst Invoice Under Rcm By Sn Panigrahi Invoicing Paying Taxes Generation

Lakshmi Associates Gst Return Accounting Firms Indirect Tax Consulting

Gst Accounting And Finalisation Of Accounts Accounting Government

Business Under Gst Overview Meaning Examples

Know Some Myths And Reality Of Gst Economics Lessons Marketing System Economics

Post a Comment for "Business Definition As Per Gst"