How To Value A Business Based On Revenue Nz

The price-earnings ratio PE ratio is the value of a business divided by its profits after tax. By comparing your business to similar ones that have been sold recently you can determine the value of your business.

Business Example 10 Passive Income Ideas To Make Money Smartly Here S Related Article Business Money New Business Ideas Business Ideas Entrepreneur

- Use a commercial data base which lists sales by business brokers throughout NZ BizStats.

How to value a business based on revenue nz. Investors will likely appraise the business based on this benchmark alone and apply a multiple to arrive at the final business valuation. The value of the businesss balance sheet is at least a starting point for determining the businesss worth. Taking the same example of a law firm suppose the profits were 40000.

But the business is probably worth. Note its not a fact and can be wide in range. It will cost you 150 GST and may provide a useful guidelines in doing business valuations.

Earnings before interest and taxes. For example a full-service restaurant with a liquor license will be worth about 30 annual gross revenue if big if its. This means that if an investor does want to finance your pre-revenue startup theyll tend to want a decent chunk of equity.

The following outlines how to value a business by capitalising the net profit. Careful research and professional advice can help you to get. That is the price a willing prudent and knowledgeable buyer and willing seller reaches in an open market.

There are three overall methodologies to value a business. Every investment has three components. Figure out how much money you can reinvest in the business.

Working out what kind of goodwill is being sold usually involves a professional tax advisor. Earnings before interest tax depreciation and amortisation. The industry profit multiplier is 199 so the approximate value is 40000 x 199 79600.

This will tell you what earnings multiples have been used in recent sales and help you value a business. Bingham confirms that at least in this country the standard approach to valuing a business is to take EBITDA look overseas and locally to find. The following are the main valuation methodologies used by business valuers.

Business Estimated Value SDE Industry Multiple Real Estate Accounts Receivable Cash on Hand Other Assets Not in SDE or Multiplier Business Liabilities. The hard truth is that until your business is post-revenue it isnt worth that much. There are three approaches to valuing a business.

A less accurate method of estimating the value of a business is to apply a percentage to the companys annual gross revenue. Add up the value of everything the business owns including all equipment and inventory. In this case to achieve a ROI of at least 50 youll need to sell your business for at least 200000.

When youre valuing a business you. They give you the knowledge and insight to eliminate wasteful spending and get to profitability faster. Discretionary Earnings are the Net Earnings of the business before Interest Taxes Depreciation and Amortization plus Managers Salary and other non-recurring expenses.

Learn How to Sell your Business How to Buy a Business How to Value a Business How to Choose a Business Broker Exit Strategy The Business Sellers Guide. EARNINGS BASED VALUATIONS Discounted Cash Flows DCF This method requires a formal business model and discounts free cash flows after excluding depreciation and allowing for expenditure on capital items. Work out the expected ROI by dividing the business expected profit by its cost and turning it into a percentage Divide the business average net profit by the ROI and multiply it by 100.

Selling price 10000050 x 100. A well-planned small business budget will. Show you how many sales you need to cover costs.

Personal or business goodwill attached to a business and dependent upon the personal relationships between the proprietor and customers local or site goodwill attached to the location and premises. B uying or sel ling a business is a major investment decision. Unless youve proven your revenue model and that there is the market demand then the investment is little more than a punt.

An answer of yes to any or all of the above means the SaaS business is one for a valuation using SDE. 2 Market-based including Direct Market Data and Rules of Thumb methods. Small business budgets are empowering.

Tally the value of assets. For example a company with a share price of 40 per share and earnings per share after tax of 8 would have a PE ratio of 5 408 5. Subtract any debts or liabilities.

Income tax depends on the type of goodwill sold. Find out when you can afford to hire help. Use this figure as the value of the business For example David is considering buying a bakery with an average net profit of 100000 after adjustments.

Determine the Cash Flow of the business. This approach can be likened to valuing a property by looking at recent sales of similar properties in the same area. Our calculator will also give you an approximate value for your business by taking the annual profit and multiplying it by the appropriate industry multiplier.

1 The dollar amount invested. You will want to find companies with similar financials within your sector and then calculate the average of trading multiples how the company operates. If your business net profit for the past year was 100000 you could work out the minimum selling price you should set.

Now you can distribute all of your balance sheet lines into the appropriate category and use the formula below to come to an estimated business value. 1 Income-based including Capitalised Earnings and Multiple of Discretionary Earnings methods. The theoretical appraised value is an opinion of fair market value by an expert.

Here are some common metrics used to value businesses using the multiple approach. Does the business generate. This method takes the business as a total operational unit and values its ability to produce returns for the shareholders.

3 Asset-based such as Asset Accumulation method.

Business Idea Investing For Beginners Business Ideas Entrepreneur Business Money Business Entrepreneurship

It Support Report Template 3 Templates Example Templates Example

Business Model Canvas Revenue Streams Illustrated In This Infographic Revenue Model Business Model Canvas Revenue Streams

Https Jay Sthilaire Mykajabi Com Growing Online Business Internet Marketing Strategy Online Business Marketing

Business Valuation Multiples By Industry Nash Advisory

7 Small Business Finance Tips For Entrepreneurs In New Zealand Bizzloans Co Nz Business Finance Small Business Finance Finance Tips

Watch Your Business Grow As Supporting Your Clients Gets Easier Success You Can Measure Globital Greatmar Grow Business Web Development Design Social Media

1901 New Zealand Dominion Of New Zealand 1d One Penny By Onetime 1 00 Postage Stamp Design Postage Stamp Collecting Rare Stamps

Aswath Damodaran Aswathdamodaran Twitter In 2021 Standard Deviation Us Data Investing

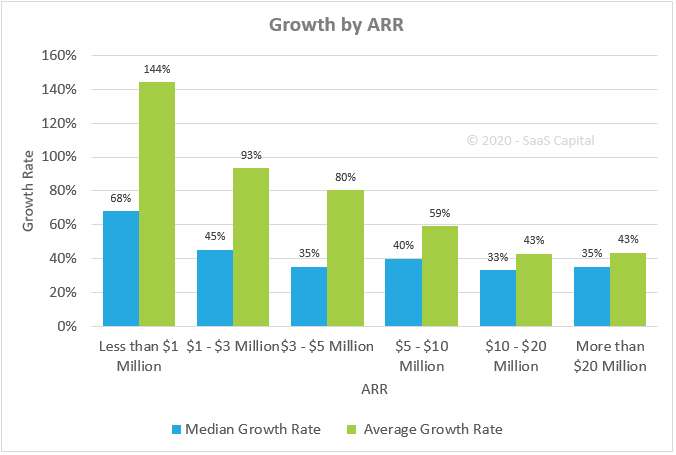

How To Create A Profit And Loss Statement Step By Step The Blueprint

How Does Netflix Make Money Fourweekmba

Grameenphone Business Model Canvas Business Model Canvas Business Model Canvas Examples Business Strategy

Business Model Strategy Google Search Financial Planner Executive Coaching Business Sales

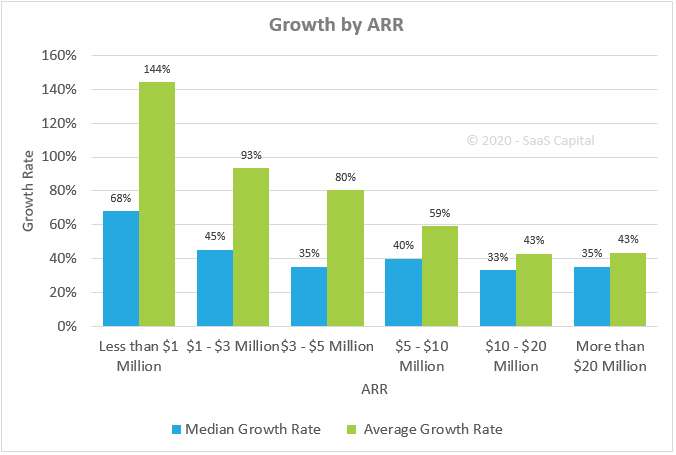

2020 Growth Benchmarks For Private Saas Companies Saas Capital

Tesla Business Model In A Nutshell Fourweekmba Revenue Model Tesla Mission Tesla

How To Create A Profit And Loss Statement Step By Step The Blueprint

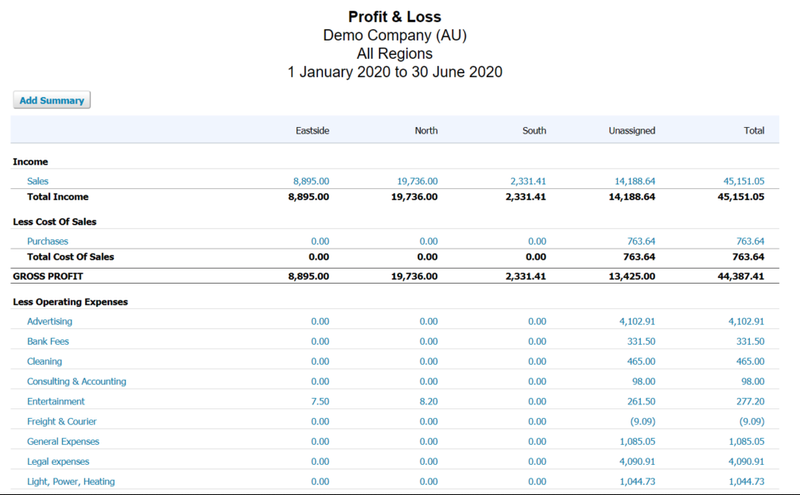

Private Saas Company Valuations Q2 2020 Update Saas Capital

Post a Comment for "How To Value A Business Based On Revenue Nz"