Business Use Of Home Simplified Method Worksheet 2017

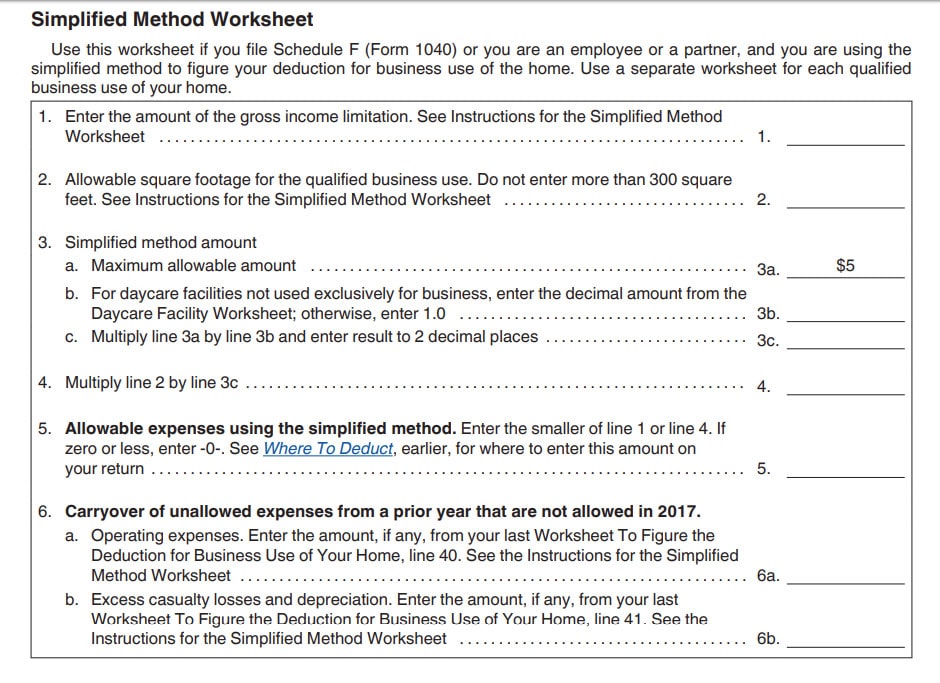

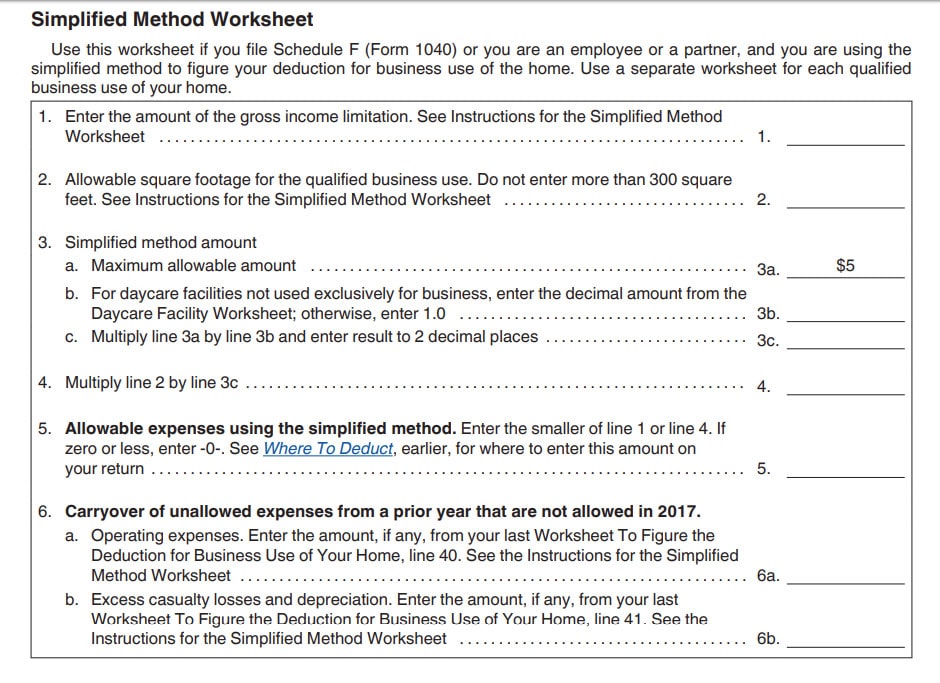

Business Use of Home Worksheet 1 Can you deduct business use of the home expenses for a home office. Allowable square footage of home use for business not to exceed 300 square feet Percentage of home used for business.

How To Deduct Your Home Office On Your Taxes Forbes Advisor

Who Can Deduct Expenses for.

Business use of home simplified method worksheet 2017. 3 Total area of the home. Amount of business expenses not related to the use of your home. That was still the rule for 2017 but since the 2013 tax year taxpayers could opt instead to use the simplified option for the home office deduction.

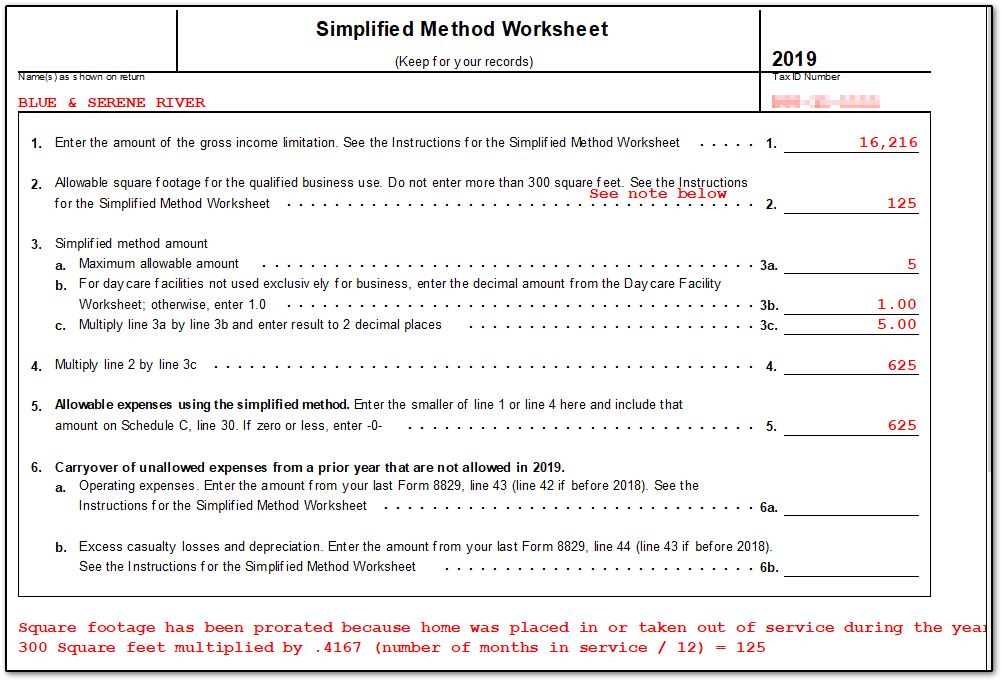

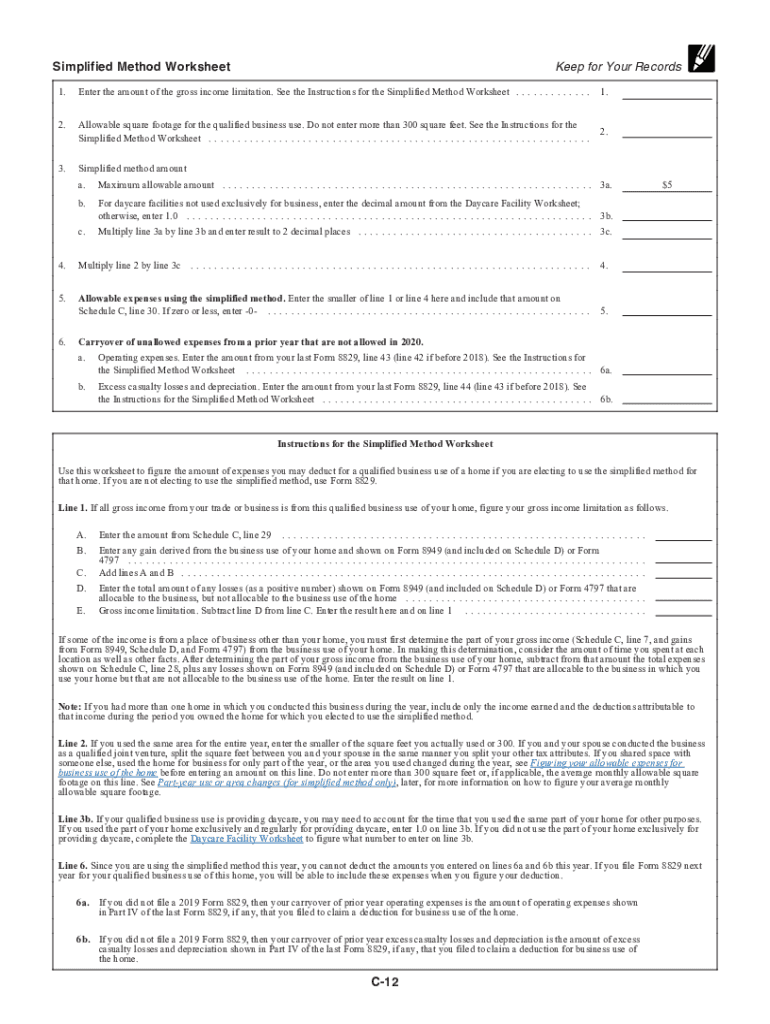

Under the simplified method the standard home office deduction amount is 5 per square foot up to 300 square feet of the area used regularly and exclusively for business. If you had more than one home during the year that you used for business you can use the simplified method for only one home. Enter the total square footage of.

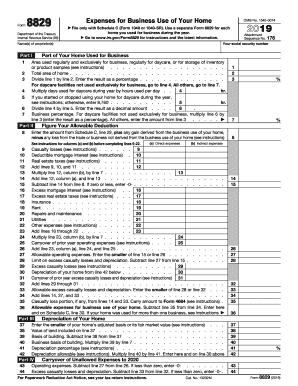

527 Residential Rental Property. First list all direct expenses such as paint wallpaper and other expenses directly related to and used in the business space. Please review the attached flowchart to determine.

With the simplified option you could claim a. Taxpayers that use their homes in a trade or business and file Schedule C Form 1040 use the Simplified Method Worksheet in the Instructions for Schedule C to figure the deduction. Your home business space deduction includes two parts.

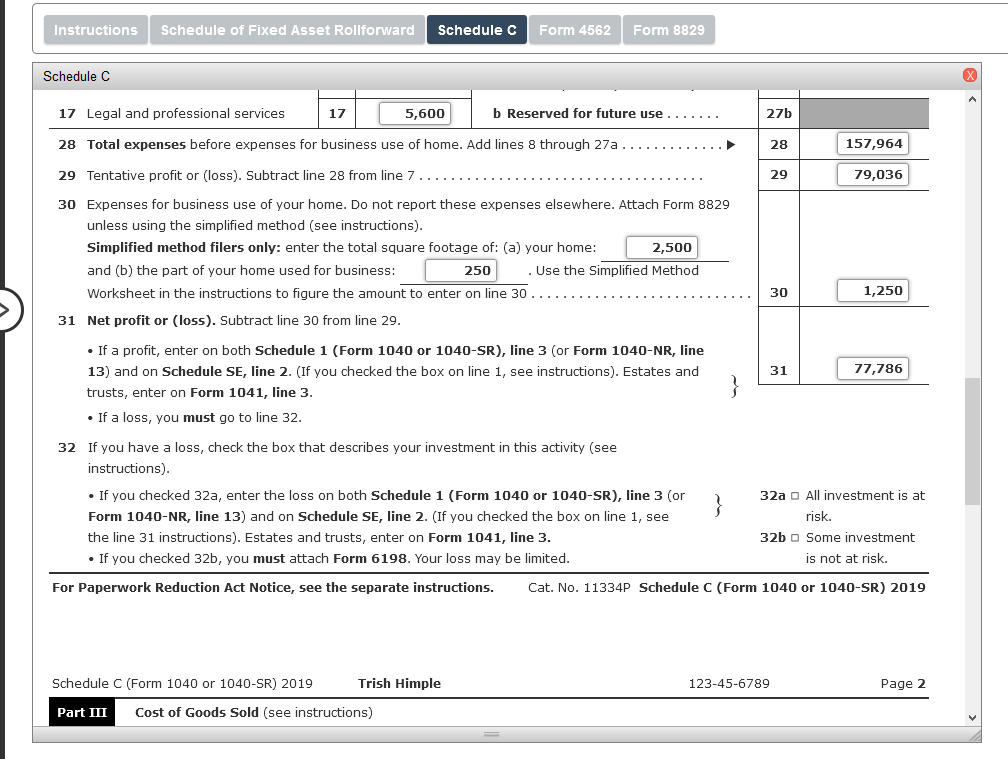

Use the Simplified Method Worksheet in the instructions to figure the amount to enter on line 30 30 31 Net profit or loss. Total area of home. Standard 5 per square foot used to determine home business deduction.

The deduction may not exceed business net income gross income derived from the qualified business use of the home minus business deductions. Unless using the simplified method see instructions. Figure out the business percentage for your home office Divide the area of your home office by the total area of your home.

For more information about the simplified method see the Instructions for Schedule C and Pub. Home-related itemized deductions claimed in. Square feet square feet 4 I choose the Simplified Option 5 per square foot of home used for business.

There is a separate worksheet to enter the business use of your home expenses. There is a separate worksheet to enter the business use of your home expenses. You can claim the business proportion of these bills by working out the actual costs.

These expenses may be deducted at 100. Enter the result as a percentage. Total area of your home in square feet _____ B.

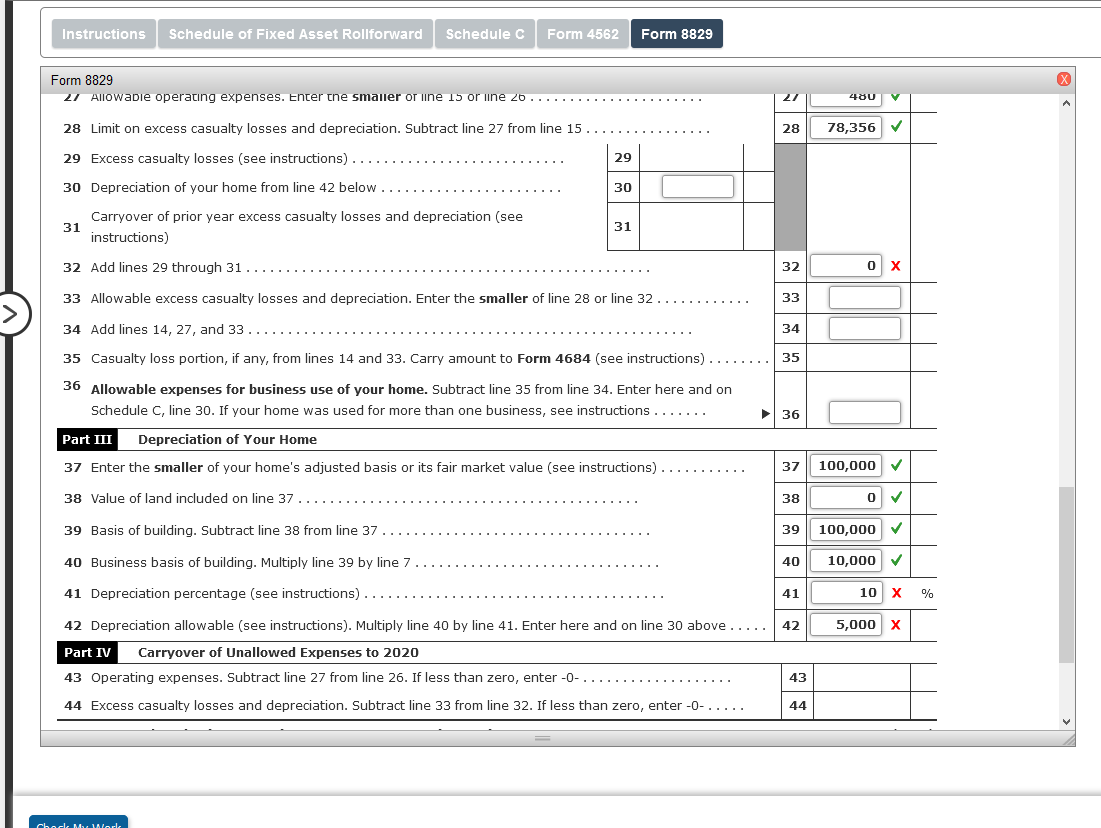

2 Area used regularly and exclusively for business. If you are not electing to use the simplified method use Form 8829 or the Worksheet To Figure the Deduction for Business Use of Your Home earlier as appropriate. You have elected to use the simplified method for this home for 2017.

Use the Simplified Method Worksheet to figure the amount of expenses you may deduct for a qualified business use of a home if you are electing to use the simplified method for that home. If you use the simplified home office deduction method theres no need for Form 8829. You can only use simplified expenses if you work for 25 hours or more a month from home.

Then calculate home business space and use the percentage to calculate all indirect expenses. Simplified method filers only. The maximum deduction is 1500.

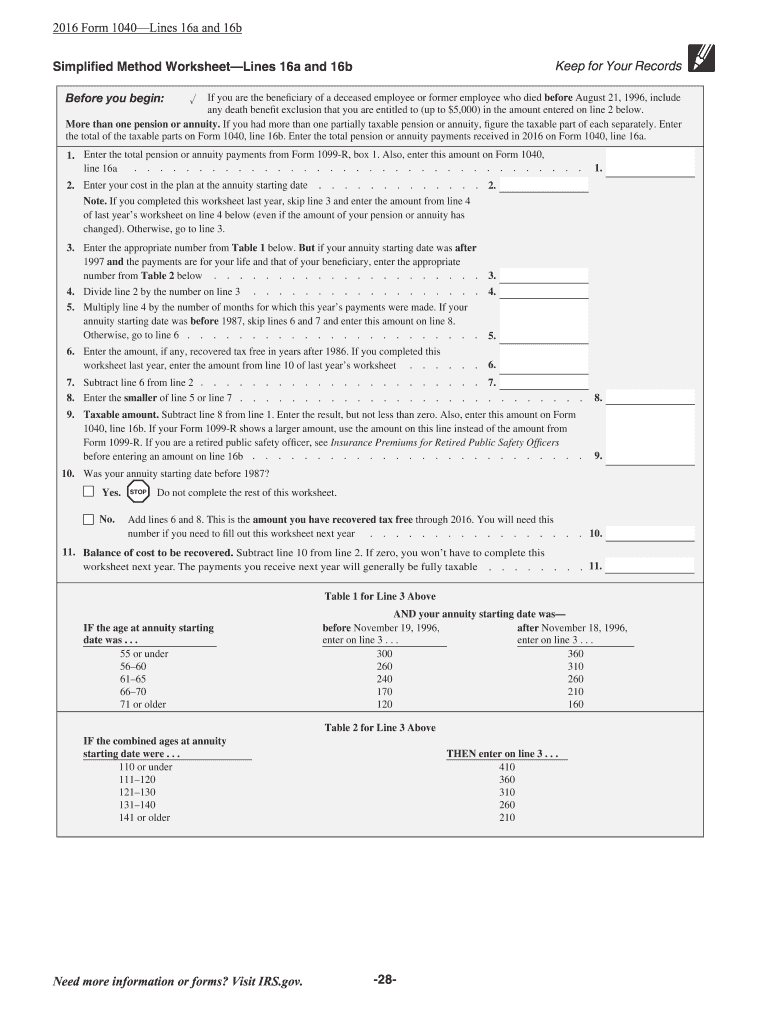

The rules in this publication apply to individuals. Standard numbering on a Form 1099-R. Click Business Income to expand the category and then click Partnership income Form 1065 Schedule K-1 Click Add Partnership Schedule K-1 to create a new copy of the form or Review to review a form already created.

If you need information on deductions for renting out your property see Pub. If you dont use the work area of your home exclusively for daycare you must reduce the prescribed rate which is a maximum of 5square foot before figuring your deduction. Actual expenses determined and records maintained.

If you use TaxSlayers simplified method worksheet enter a note with the taxpayers annuity start date age at the start date and amounts. Divide line 1 by line 2. 10 rows Simplified Option Regular Method.

Instead you use the worksheet in the Schedule C instructions. Area of your home office space in square feet _____. Hours of business use.

Income from business use of your home. Click Business Income to expand the category and then click Partnership income Form 1065 Schedule K-1 Click Add to create a new copy of the form or Review to review a form already created. Use the Simplified Method Worksheet in the instructions for Schedule C for your daycare business.

Multiply days used for daycare during year by hours used per day. If you used your home for business and you are filing Schedule C Form 1040 you will use either Form 8829 or the Simplified Method Worksheet in your In- structions for Schedule C. Subtract line 30 from line 29.

All others go to line 7. Deduction for home office use of a. Continue to the screen Partnership - Unreimbursed Partnership Expenses and enter the expenses Note.

And b the part of your home used for business. 3 For daycare facilities not used exclusively for business go to line 4. If the taxable amount isnt calculated in Box 2 the Simplified Method must be used.

If you have any questions regarding the new safe harbor method please do not hesitate to contact us. Continue to the screen Partnership - Unreimbursed Partnership Expenses and enter the expenses Note. Use Form 8829 to claim expenses for business use of the other home.

Https Www Irs Gov Pub Irs Prior P587 2018 Pdf

Fill Free Fillable Irs Pdf Forms

Solved Instructions Comprehensive Problem 8 1 Trish Himpl Chegg Com

8829 Simplified Method Worksheet Fill Out And Sign Printable Pdf Template Signnow

Schedule C Self Employment Covered Ca Subsidies Home Office Hobby

Solved Instructions Comprehensive Problem 8 1 Trish Himpl Chegg Com

Home Office Deduction Definition Eligibility Limits Exceldatapro

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Home Office Income Limitations Taxcpe

S I M P L I F I E D M E T H O D W O R K S H E E T Zonealarm Results

S I M P L I F I E D M E T H O D W O R K S H E E T Zonealarm Results

2020 Form Irs Instructions 1040 Schedule C Fill Online Printable Fillable Blank Pdffiller

Home Office Deduction How To Use The Simplified Method Easy What If I Rent My Home Youtube

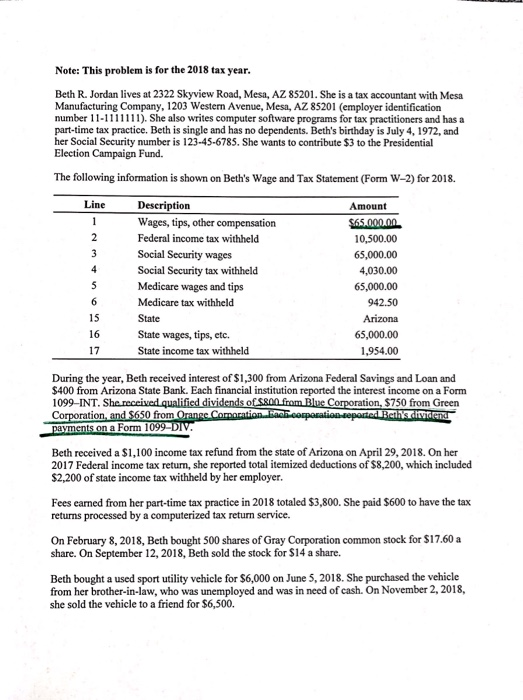

Note This Problem Is For The 2018 Tax Year Beth Chegg Com

Schedule C Self Employment Covered Ca Subsidies Home Office Hobby

Irs Offers An Easier Way To Deduct Your Home Office Don T Mess With Taxes

Form 8829 Fill Out And Sign Printable Pdf Template Signnow

2017 Schedule C Form 1040 Pdf Schedule C Form 1040 Profit Or Loss From Business Omb No 1545 0074 2017 Sole Proprietorship To Www Irs Gov Schedulec Course Hero

How To Deduct Your Home Office On Your Taxes Forbes Advisor

Post a Comment for "Business Use Of Home Simplified Method Worksheet 2017"