Business Cash Receipts Journal Meaning

The cash receipts journal manages all cash inflows of a business organization. Join PRO or PRO Plus and Get.

A Cash Book Is A Financial Journal In Which Cash Receipts And Payments Including Bank Deposits And Withdrawals Are Recorded First I Accounting Notes Cash Books

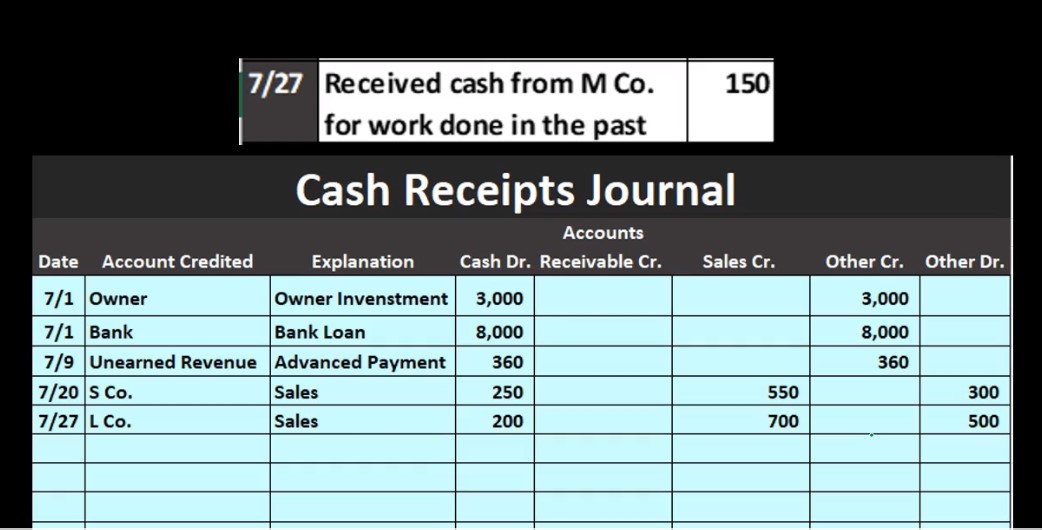

Definition Cash receipt journal is a special journal that is used for the purpose of recording cash received by a business from any source.

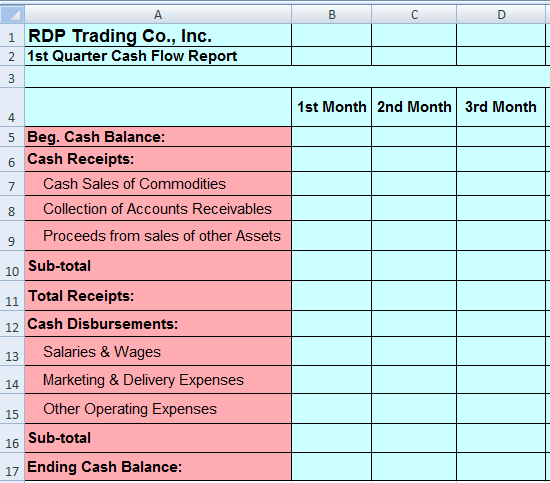

Business cash receipts journal meaning. A cash receipt also becomes important because one of the major reason for an audit is the lack of documents such as cash receipts to support the existence of the transaction. Record the following. One of the journals is a cash receipts journal a record of all of the cash that a business takes in.

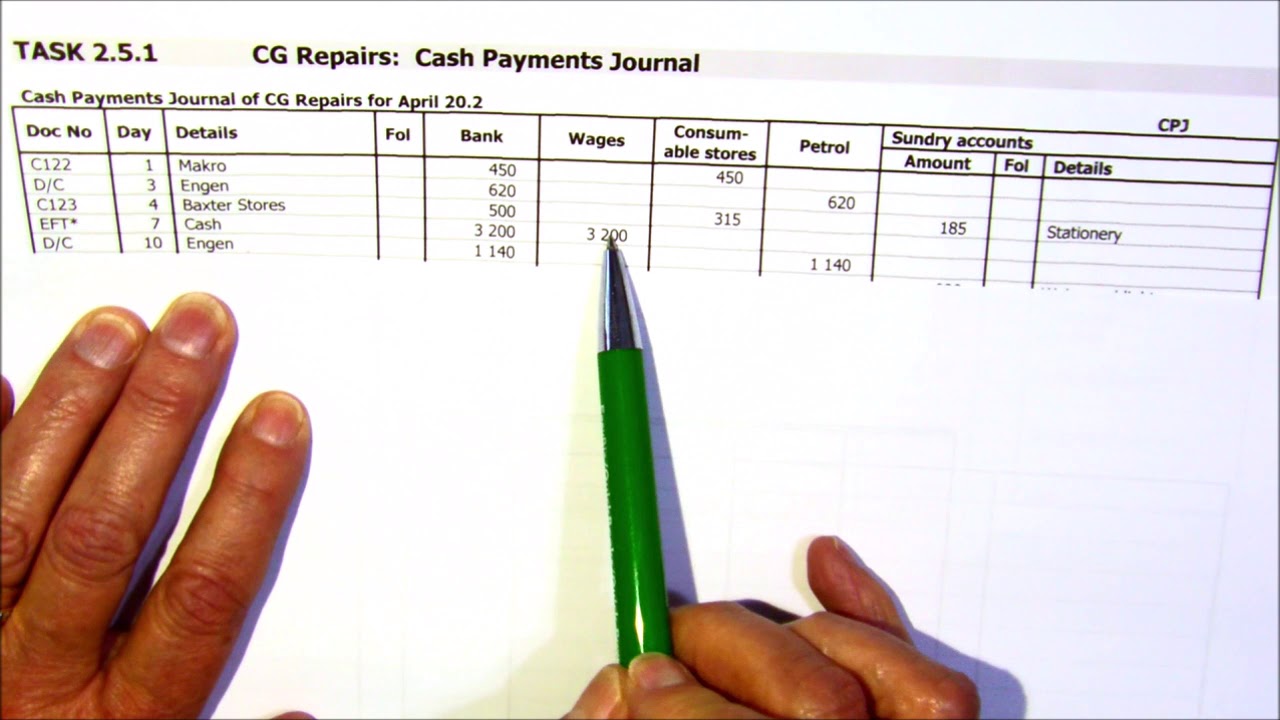

In your journal you will want to record. For recording all cash outflows another journal known as cash disbursements journal or cash payments journal is used. One of the journals is a cash receipts journal a record of all of the cash.

Or The special journal used to record cash disbursements made by check is called a cash payment journal. Do you want to know how to manually process customer payments in Business Central. 43 A book to record transactions where money is taken OUT of the business bank account.

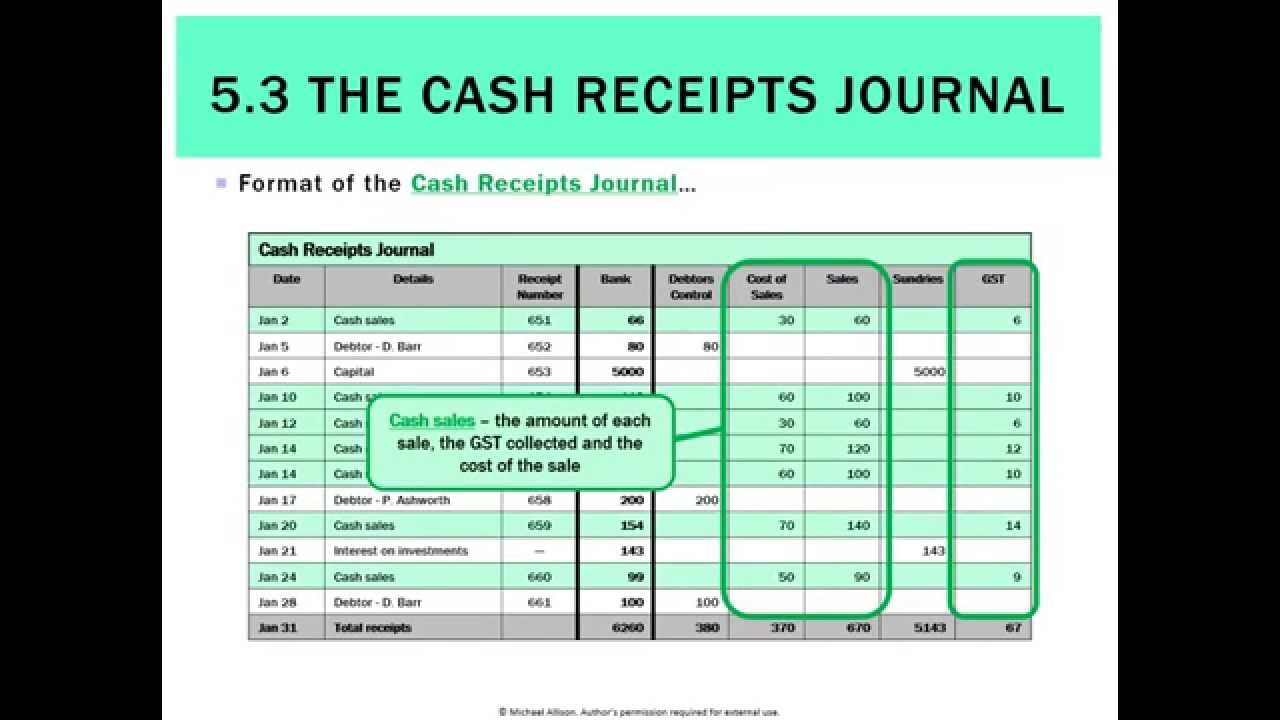

The cash receipts journal is that type of accounting journal which is only used to record all receipts of cash during an accounting period and works on the golden rule of accounting debit what comes in and credits what goes out. It is reserved specifically for activities that involve receiving cash. What Does Cash Receipts Journal Mean.

Cash payment journal or cash disbursement journal is used to record all cash payments made by the business. A cash disbursement journal is a record of a companys internal accounts that itemizes all financial expenditures made with cash or cash equivalents. In other words the cash receipts journal is a separate journal only used to record cash collections.

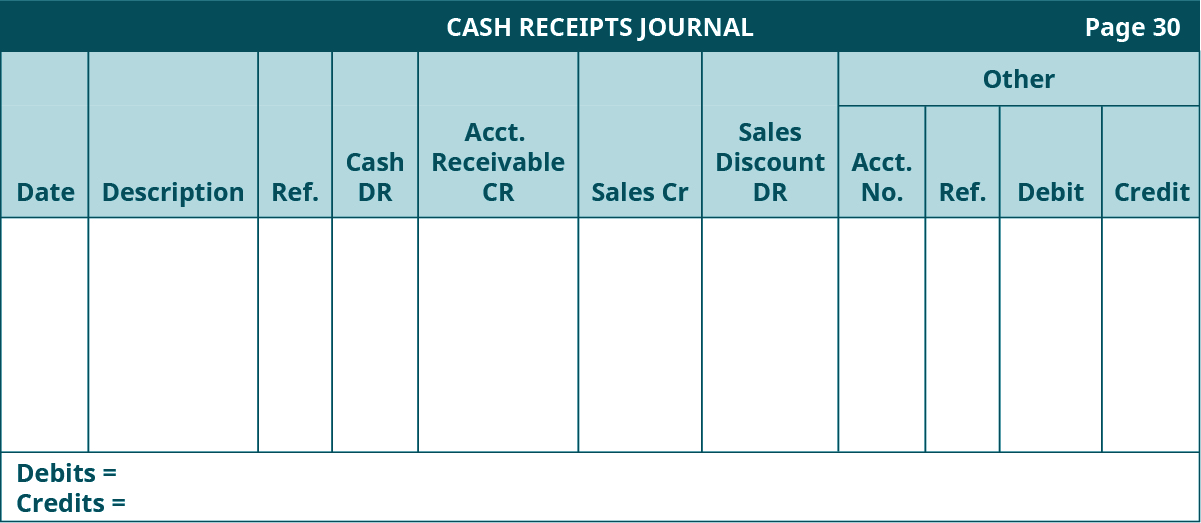

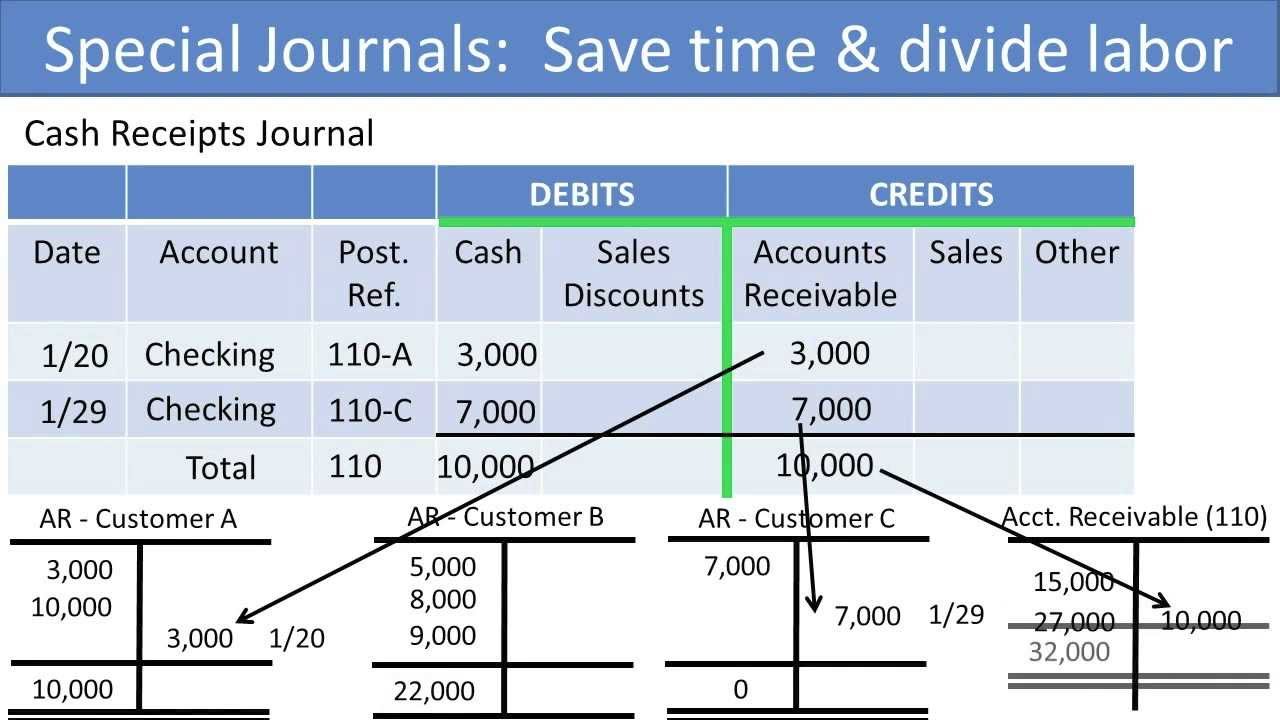

They are also known as a subsidiary ledger which is used to record sales and they also. In a manual system this will allow one entry to the Cash account for the month or shorter periods instead of debiting the Cash account for every receipt. Record all of your incoming cash in your journal.

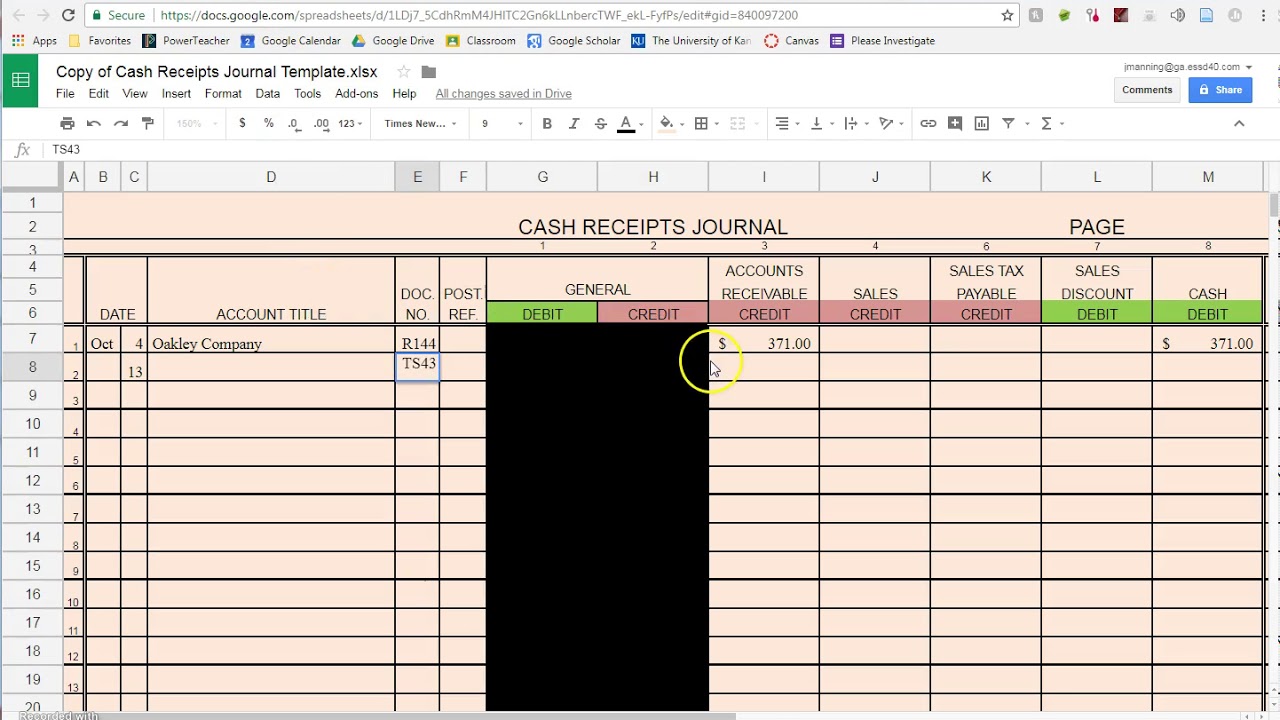

Your cash receipts journal manages all cash inflows for your business. 44 Cheques and a bank statement. This module will focus on how to enter payments manually in the cash receipt journal and payment journal and it will also explain how to apply payments.

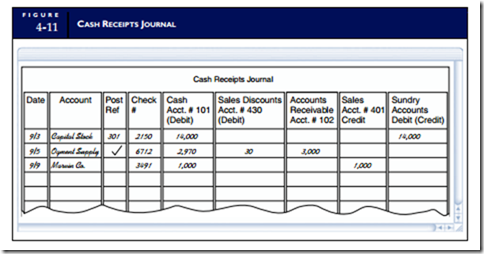

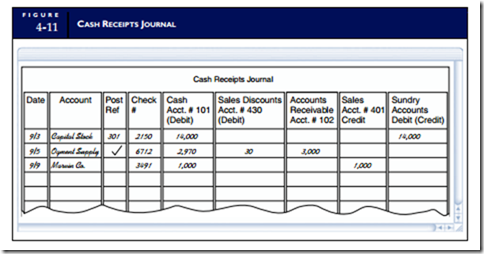

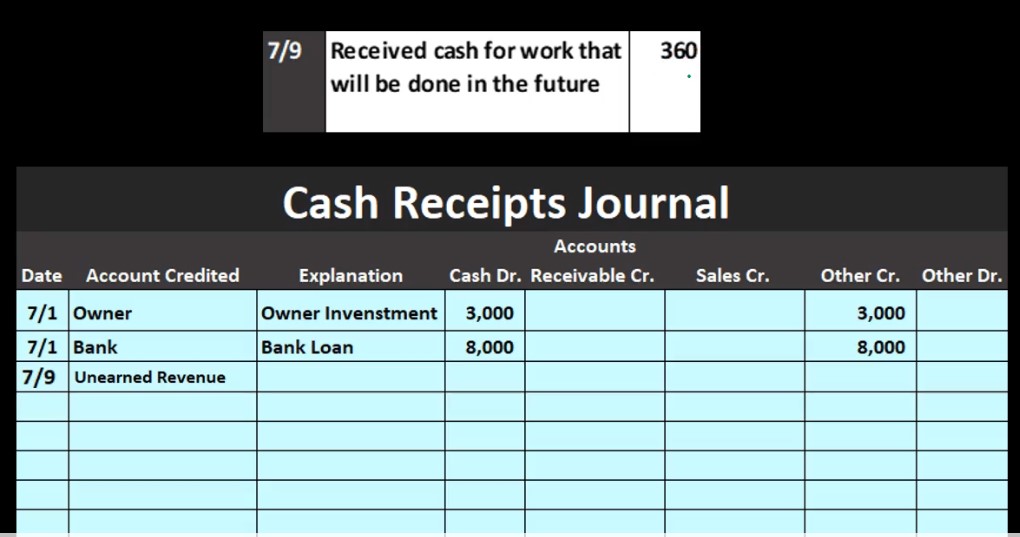

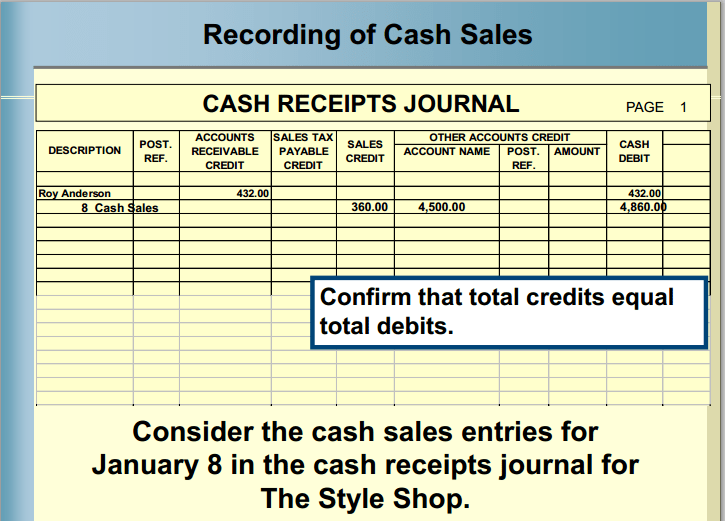

The cash receipts journal is a special section of the general journal specifically used to record all receipts of cash. The journal is simply a chronological listing of all receipts including both cash and checks and is used to save time avoid cluttering the general ledger with. Cash receipts journal definition A special journal or specialized journal used to record money received.

You may sell items or provide services that people pay for with cash which may range from food or books to massages or even a ride in a taxicab. A cash disbursement journal is done before. In other words this journal is used to record all cash coming into the business.

A cash payment journal is a special journal that allows you to record all cash payments - that is all transactions during which you spend funds. The cash receipts journal is a special journal used to record the receipt of cash by a business. For example if you paid cash to any of your.

41 Cash Payment Journal CPJ 42 Cash payment journal of CURLY HAIR SALON for August 2017. Cash Receipts Journal In accounting journals are used to record similar activities and to keep transactions organized. If so then this module is for you.

45 It is the name of the person to whom the business is paying money or a cash cheque. The major sources of cash receipt in a business are as follows. In simple words Cash Receipts Journal can be defined as a section which is special for a general journal and they are mainly used to maintain a record of all the receipts of cash.

Investment of capital by the proprietor owner. As such having cash receipts and proper filing will avoid the risk of audit issues. Your cash receipts journal typically includes cash sales and credit categories.

Prepare A Subsidiary Ledger Principles Of Accounting Volume 1 Financial Accounting

Recording Transactions Into A Cash Receipts Journal Youtube

Post A Cash Receipts Journal To A General Ledger Simple Accounting

Cash Receipts Journal 40 Accounting Instruction Help How To Financial Managerial

5 3 The Cash Receipts Journal Youtube

Cash Receipts Journal 40 Accounting Instruction Help How To Financial Managerial

Receipts And Adjustments Journal

Accounting Journals The Books Of First Entry

Accounting Journals The Books Of First Entry

Cash Receipts Journal 40 Accounting Instruction Help How To Financial Managerial

Cash Receipts Journal 40 Accounting Instruction Help How To Financial Managerial

Cash Receipts Journal Personal Accounting

Cash Receipts Journal Definition Examples Video Lesson Transcript Study Com

Accounting Journals The Books Of First Entry

Special Journals Financial Accounting

Free Cash Flow Statement Templates Smartsheet Cash Flow Statement Bookkeeping Business Accounting Basics

Cash Receipt Accountingtools Simple Accounting

Cash Disbursement Journal Double Entry Bookkeeping

Post a Comment for "Business Cash Receipts Journal Meaning"