Small Business Administration Loans California

Women-owned small businesses can also take advantage of SBA loan programsOur partners offer advice and counseling to help choose the right path for your company. For details see the Small Business Debt Relief Program section page 9 of the Small Business Owners Guide to COVID-19 Relief Legislation PDF Download.

Sba Paycheck Protection Program Has Run Out Of Money But Outstanding Loan Applications Will Be Processed Newsday

SBA loans require much more paperwork and documents and have more strict guidelines.

Small business administration loans california. The State of California is allocating 50 million to the Small Business Finance Center at Californias IBank to mitigate barriers to capital for those small businesses 1-750 employees that may not qualify for federal funds including businesses in low-wealth and immigrant communities. Small nonfarm businesses in Ventura Kern Los Angeles and Santa Barbara counties are now eligible to apply for lowinterest federal disaster loans from the US. And its not just us.

That makes it easier for small businesses to get loans. Our loans help small business owners like you thrive be successful and create jobs in our communities. As an SBA Preferred Lender we can help you find government-guaranteed SBA loan options that fit your business needs while allowing you to seize opportunities.

Usually SBA loans term is 25 years. SBA acted under its own authority as provided by the Coronavirus Preparedness and Response. Instead it sets guidelines for loans made by its partnering lenders community development organizations and micro-lending institutions.

For non-COVID-19 related questions about how we can help your small business and other general information email SBAs Answer Desk. EMAIL Contact SBAs Answer Desk at 1-800-827-5722 or answerdesksbagov Monday-Friday 9am to 6pm ET or speak with an American Sign Language ASL interpreter via videophone at 1-855-440-4960. Small Business Administration is offering low-interest federal disaster loans for working capital to California small businesses suffering substantial economic injury as a result of the Coronavirus COVID-19 SBA Administrator Jovita Carranza announced today.

CDTFA has received 82 million in payments towards the small business relief payment plans. The 8a Business Development program helps small disadvantaged businesses compete in the marketplace. California Sacramento California Sacramento Read more about Sacramento District Year --to- Date Loans.

409 3rd St SW. The agency doesnt lend money directly to small business owners. Access to Capital Provided 125 Million in Small Business Loans.

The SBA reduces risk for lenders and makes it easier for them to access capital. The California Infrastructure Economic. Pacific Community Ventures can help.

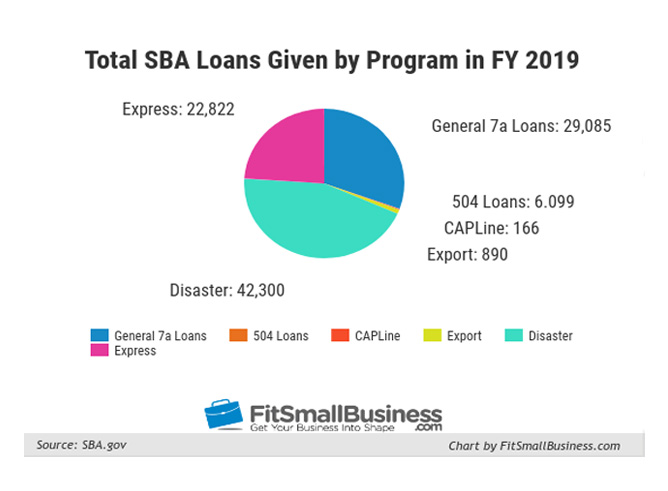

Many of the major SBA-approved lending. SBAs Debt Relief Program pays the principal interest and fees for six months for 7 a 504 and Microloans disbursed before September 27 2020. Check with WBCs and local assistance resources for guidance and our Lender Match tool for finding capital.

Financial analysis shows that California is one of the best places for small business owners to grow their businesses. SBA 7a and SBA 504. These products usually offer variable rates.

Whatever your situation may be SBA-backed loans are extremely useful for any small business in California and SBAExpressLoans Inc. 14 rows Small Business Relief Payment Plans for Sales and Use Tax State California currently. Washington DC 20416.

Were a mission-driven lender that provides fair and affordable loans up to 200000 to California small businesses. Is standing by to provide you with all the help you need to get the financing your small business needs. Small Business Administration announced Director Tanya N.

Beginning in February 2021 that relief was extended for certain businesses. Garfield of SBAs Disaster Field Operations Center-West. Small Business Administration SBA Loans.

When you see new opportunities to grow your business think about SBA financing through California Bank Trust an excellent solution for expanding your business renovating or building. Read more about Year to Date Lender Totals October - April. Small Business Administration is offering low-interest federal disaster loans for working capital to California small businesses suffering substantial economic injury as a result of the Coronavirus COVID-19 SBA Administrator Jovita Carranza announced today.

We facilitate financing for acquisitions construction refinance and working capital through SBA USDA Conventional Loans and Private Funds across the United States. With decades of relevant experience and strategic relationships in the industry CCS can serve commercial financing and business consulting needs across the United States. A total of 6217 Small Business Relief Payment Plans have been established for a total of 1059 million in tax through August 30.

The SBA works with lenders to provide loans to small businesses.

Sba Rolls Out 100m Grant Program To Help Small Businesses Recover From Covid Fallout Masslive Com

Sba Reopens Online Applications For Disaster Loans Newsday

11 Steps To Apply For The Coronavirus Disaster Loan Finder Com

Emergency Funding For Small Business How To Qualify Funding Circle

9 Startup Business Loans For Bad Credit 2021 Badcredit Org

Opinion Relaxed Loan Terms From The Small Business Administration Offer A Ray Of Hope For Small Businesses Marketwatch

Sba Loans Types Rates Requirements

Orange County Small Business Development Center Ocsbdc

Beware Of Emerging Scams Cares Act Financial Scams And Fraud Targeting Small Businesses Snell Wilmer Jdsupra

Sba Paycheck Protection Ppp Loans For Construction How To Apply

Learn About Sba Certified Development Company 504 Loans For Financing Small Businesses And Developing Community Economies Sba Loans Small Business Loans Loan

Sba Paycheck Protection Program Funds Exhausted Before Deadline Here S What You Can Do Silive Com

Sba Paycheck Protection Ppp Loans For Construction How To Apply

Sba Loans For Business The Pros Cons Nav

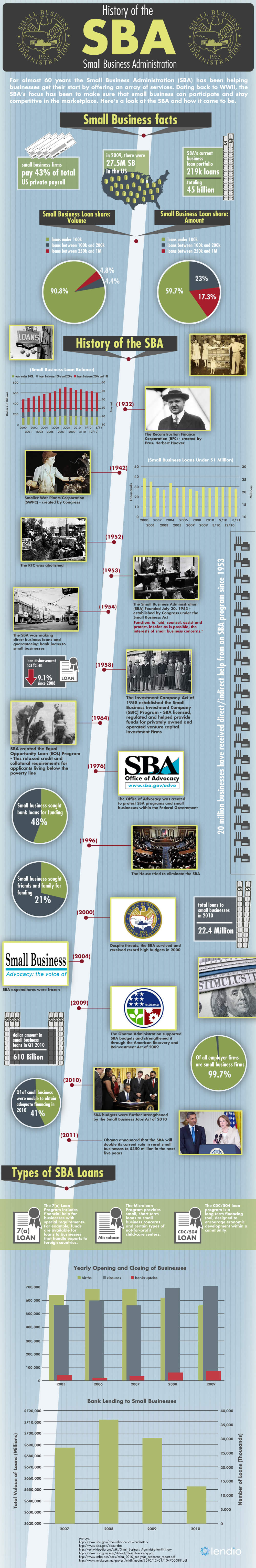

History Of The Small Business Administration Infographic

A Master List Of States And Counties Eligible For Sba Coronavirus Relief Loans Workest

Fill Free Fillable Forms U S Small Business Administration

Sba Loans What You Need To Know For Your Business Lendio

California Small Business Loans Sba Express Loans

Post a Comment for "Small Business Administration Loans California"