How Do I Find My Business Tax Id Number Missouri

If you do not have one leave this field blank. Box 357 Jefferson City MO 65105-0357.

Tax Id Numbers A Simple Guide Bench Accounting

The program wont accept it because it is not 9 numbers and in the format 123456-78-9.

How do i find my business tax id number missouri. Applying for an EIN with the IRS is free 0. If you need help with a Missouri tax ID number you can post your legal need on UpCounsels marketplace. Missouri State Website.

Lookup a Business Entity Step 1 Start. Businesses in Missouri are required to file for both federal and state tax identification numbers. You can find your Withholding Account Number on any previous quarterly return or on any notices you have received from the Department of Revenue.

If you have ever been issued a Missouri Tax ID. Consumers Use Tax - If your Missouri business stores uses or consumes tangible personal property that is purchased from a seller who does not collect tax you are responsible for remitting the use tax to Missouri. Complete the Missouri tax registration application and mail it to the Missouri Department of Revenue at PO.

This is the original document the IRS issued when you first applied for. 247 Missouri Business Online Business Registration Secretary of State - Businesses Department of Economic Development. If your EIN has changed recently which could render any old documents useless you should definitely call the IRS.

Find Your Missouri Tax ID Numbers and Rates Missouri Withholding Account Number. Your previously filed return should be notated with your EIN. The state says that it is the correct number and account that I have an employer withholding account.

Small Business Events in Your Area. Find a previously filed tax return for your existing entity if you have filed a return for which you have your lost or misplaced EIN. This system is available to all business accounts registered with the department and doesnt require a separate registration.

The information and links below will explain the process to apply as well as assist new businesses to understand the requirements for business registration. Department of Revenue - Business Tax. A companys employer ID number or EIN appears on every invoice and most financial documents from the company.

Doing Business in the State. Contact Business Tax Registration. Online approval takes 15 minutes.

Search a business entity Corporation LLC or Limited Partnership in Missouri by going to the Secretary of States Website and lookup by. If youre unable to locate this contact the agency at 573 751-8750. If you decide to choose the By Name option ensure that you use as many terms as you can to narrow down the results.

UpCounsel accepts only the top 5 percent of lawyers to its site. These numbers are most commonly used to register a business with the federal and state government in order to pay sales taxes payroll taxes and withhold taxes. Missouri Employer Account Number.

- 700 pm. The hours of operation are 700 am. If you make retail sales in Missouri that are subject to Missouri sales or vendors use tax the number is also included on your license.

Once the Missouri Department of Revenue has received your application a representative will review it and issue your business a tax identification number within one to two weeks. One of several steps most businesses will need to take when starting a business in Missouri is to register for an Employer Identification Number EIN and Missouri state tax ID numbers. Once the registration application has been received and your account is properly registered you will receive notification of your tax identification number by mail.

If you are not a registered MyTax Missouri user you can file and pay the following Business taxes online using a credit card or E-Check electronic bank draft. Department of Labor and Industrial Relations Unemployment Insurance Tax. You can get an EIN for your Missouri LLC online by fax or by mail.

LLC University will show you how to get an EIN Number Federal Tax ID Number for a Missouri LLC. I received an employer tax number from my state but it is 8 numbers. You may be required to submit a Federal Employer Identification Number FEIN to complete your business registration.

There are however additional charges or convenience. Number by the Missouri Department of Revenue enter it here. Use tax does not apply if the purchase is from a Missouri retailer because this transaction would be subject to Missouri sales tax.

UpCounsel accepts only the top 5 percent of lawyers to its site. If all else fails and you really cannot find your EIN on existing documents you can reach out to the IRS by calling the Business Specialty Tax Line at 800-829-4933. Make sure to call between the hours 7 am.

Do I just put my number. Your identification number is the 8 digit number issued to you by the Missouri Department of Revenue to file your business taxes. Ask the IRS to search for your EIN by calling the Business Specialty Tax Line at 800-829-4933.

The easiest way to find your EIN is to dig up your EIN confirmation letter. Your PIN is a 4 digit number located on the cover of your voucher booklet or return. What types of returns can I file using the SalesUse Tax.

If you need to find the employer ID number of a company based in Missouri you can search for records both within the state and with the Securities and Exchange. If additional information is required in order for the department to properly register your business you will receive notification by mail of the additional information needed. If you have additional questions or concerns please contact Business Tax Registration by email at businesstaxregisterdormogov or.

Check your EIN confirmation letter.

Missouri Driver S License Application And Renewal 2021

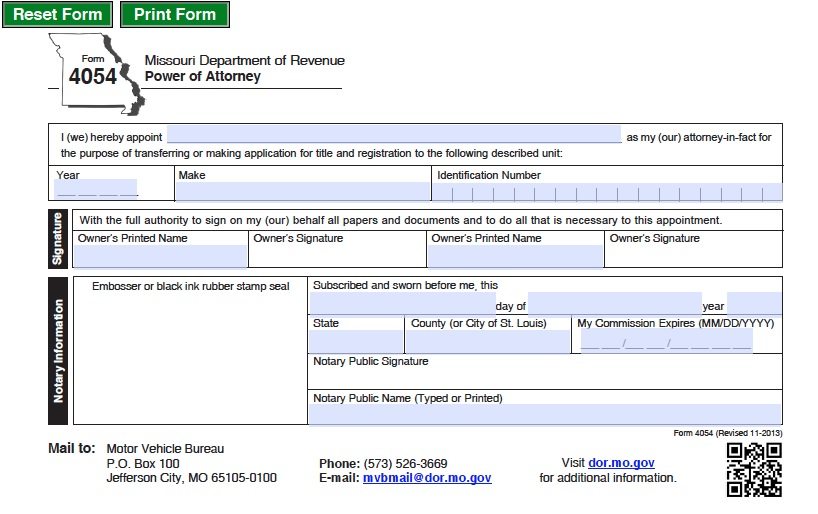

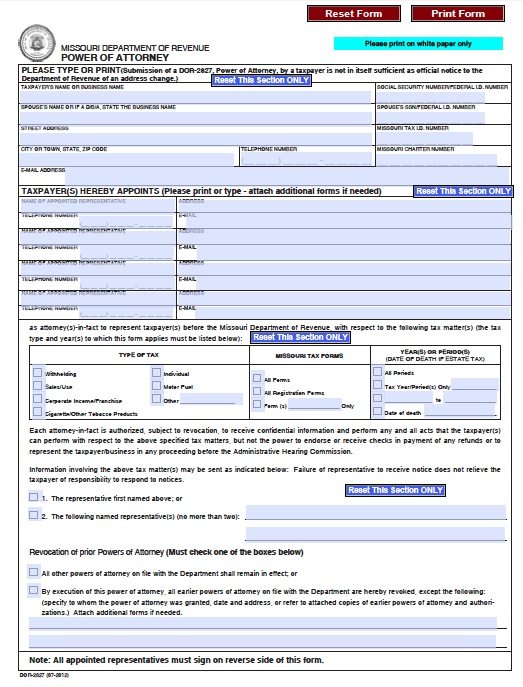

Free Missouri Power Of Attorney Forms Pdf Templates

Https Stlouiscountymo Gov St Louis County Government County Assessor Assessor Forms Business Personal Property Registration Merchant Or Manufacturer License

Https Dor Mo Gov Forms Missouri Titling Manual Pdf

Free Missouri Power Of Attorney Forms Pdf Templates

Online No Tax Due System Information

Change Your Business Name With The Irs Harvard Business Services

Https Dor Mo Gov Forms 126 Pdf

Https Dor Mo Gov Forms 53 C Pdf

How To Get A Sales Tax Exemption Certificate In Wisconsin Startingyourbusiness Com

Online No Tax Due System Information

Https Dor Mo Gov Forms Missouri Titling Manual Pdf

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

How To Get A Sales Tax Exemption Certificate In Iowa Startingyourbusiness Com

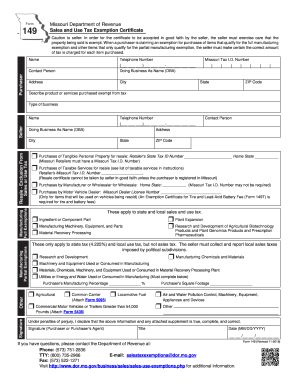

2019 2021 Form Mo Dor 149 Fill Online Printable Fillable Blank Pdffiller

Https Dor Mo Gov Forms 426 Pdf

Https Dor Mo Gov Forms Mo 1040 20instructions 2020 Pdf

Post a Comment for "How Do I Find My Business Tax Id Number Missouri"