Ohio Municipal Net Profit Tax Rates

This tax is reported annually on the Form 27 Net Profits Tax Return. Municipal Net Profit Tax Estimated Payment Deadline Reminder PDF 09022020.

Https Tax Ohio Gov Portals 0 Muni Net Profit Instructionsfordeclarationofestimatedpayments Pdf

Bill Roemer R-Richfield said.

Ohio municipal net profit tax rates. RR Qualified municipal corporation means a municipal corporation that by resolution or ordinance adopted on or before December 31 2011 adopted Ohio adjusted gross income as defined by section 574701 of the Revised Code as the income subject to tax for the purposes of imposing a municipal income tax. 31 Will municipalities earn interest on the net profit tax revenue. Distribution of the revenue received for a given month will be paid directly to the municipalities by the fifth of the 2nd subsequent month.

The Ohio Department of Taxations role in the municipal income tax is limited to administration of the tax for electric light companies and local exchange telephone companies and for those businesses that have opted-in with the tax commissioner for municipal net profit taxAll other business taxpayers as well as all individual taxpayers should. Taxpayers may use the secure drop box located in the lobby of the 77 N. Municipal Net Profit Tax.

Monday through Friday 900 am. 75 2020 September 28 2020 MUNICIPAL INCOME TAX. Ohio Department of Taxation is excited to announce a new feature Online Notice Response Service PDF 09102020.

The name of the Ohio Municipality. Tax Analysis Division 4485 Northland Ridge Blvd Columbus Ohio 43229 F 2063090360 taxohiogov Table LG11 No. Penalty Unpaid Tax.

Front Street 2nd Floor. As if the complications of the tax code itself werent enough the state also requires businesses to jump through unnecessary administration hoops to meet their tax. Cincinnati Earnings Tax Rate Reduced to 18 on October 2 2020.

675 must be paid by the fifteenth day of the ninth month of their taxable year. The Cincinnati earnings income tax rate is reduced from 21 to the new tax rate 18. This is the tax on the income earned by the business in the municipality.

Electronic Payment Municipal net profit taxpayers are required to remit each tax payment electronically either by ACH debit through the Gateway or by electronic funds transfer EFT through the Ohio Treasurer of State at tosohiogov. It may not be all inclusive and is subject to change without notice. Due to the COVID-19 pandemic the Division is currently closed to the public.

MUNICIPAL NET PROFIT TAX FILING DEADLINE REMINDER PDF 08312020. Click here for the estimated payment due date table. March 31 2020.

The current system for filing municipal net profits tax in Ohio creates unnecessary paperwork for our hard-working business owners Rep. 71885B amounts received for the municipal net profit tax are credited to the municipal income tax fund. Beginning with Tax Year 2019 individuals under 18 years of age are exempt from paying municipal income tax.

312018 2 Background Philadelphia PA 1st Municipal Income Tax in US. If the due date falls on a weekend or holiday the report or payment is due the next business day. Administered municipal net profit tax option for taxable years beginning on or after January 1 2018.

The first one is due on or before the 15 th day of. The declarations and returns will include all municipal corporations in which the business is subject to tax and the corresponding payments for the combined tax. SS1 Pre-2017 net operating.

1938-39 Toledo 1st Ohio municipality to enact income tax 1946 Ohio cities and villages begin to adopt income tax Late 1960sEarly 1970s Background The municipal income tax applies to Individuals who. Revenue accounted for in April is due June 5th Allocation Worksheet - Provides detailed definitions of the categories of monies distributed. Tax Rates and Net Collections by Municipality Calendar Year 2018.

This list is intended for reference purposes only. Tax Day extended to May 17 2021. The approval of the Hamilton County sales and use tax levy to provide general revenues for the Southwest Ohio Regional Transit Authority eliminated the 3 Transit earnings tax.

Beginning with losses incurred in 2017 a net operating loss may be carried forward for 5 years. Taxpayers that opt-in with the Department will file declarations make payments and file tax returns with the Department on the Ohio Business Gateway. 90 must be paid by the fifteenth day of the twelfth month of their taxable year.

614 645-7193 Customer Service Hours. For Tax Year 2018 and prior individuals under 18 years of age are NOT exempt from paying municipal income tax. Earn taxable income in one or more Ohio municipalities and.

As a tool for our audit teams and a service to the tax community the Division of Income Tax annually compiles information from Ohio municipalities on their income tax. A penalty may be imposed on unpaid income tax including unpaid estimated tax equal to 15 of the amount not timely paid. As a result of legislation passed by the Ohio General Assembly penalty and interest rates for Ohio municipal income tax for years beginning on or after January l 2016 will be as stated below.

City of Columbus Income Tax Division 77 N. Interest accruing to the municipal income tax fund will be distributed in accordance with RC. Front Street building to drop.

The amount of net operating loss carry forward that may be utilized is limited to the lesser of 50 of the carried forward loss or 50 of that years income. Losses incurred in tax years 2017 through 2021 are subject to a 50 phase-in limitation. Municipal Income Tax Rate.

Amounts under 1001 will not be collected or refunded. Payments may be made beginning in February of 2018. In addition to filing the Form 27 the business is required to make quarterly estimated tax payments.

The Net Profit tax is also a municipal income tax.

Https Tax Ohio Gov Portals 0 Muni Net Profit Instructionsfordeclarationofestimatedpayments Pdf

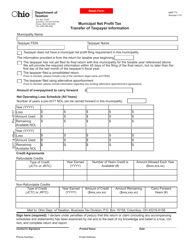

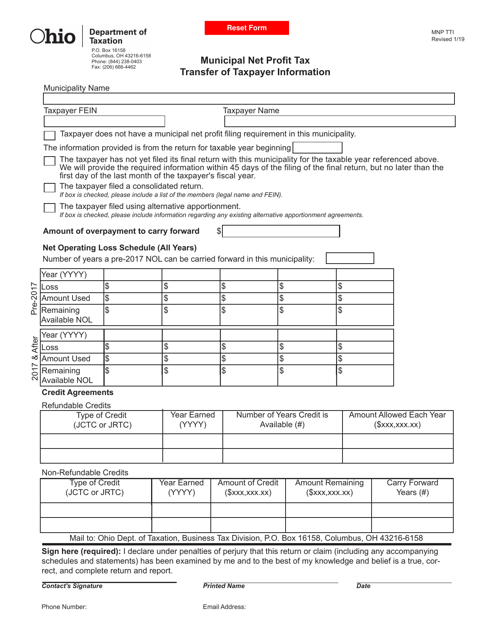

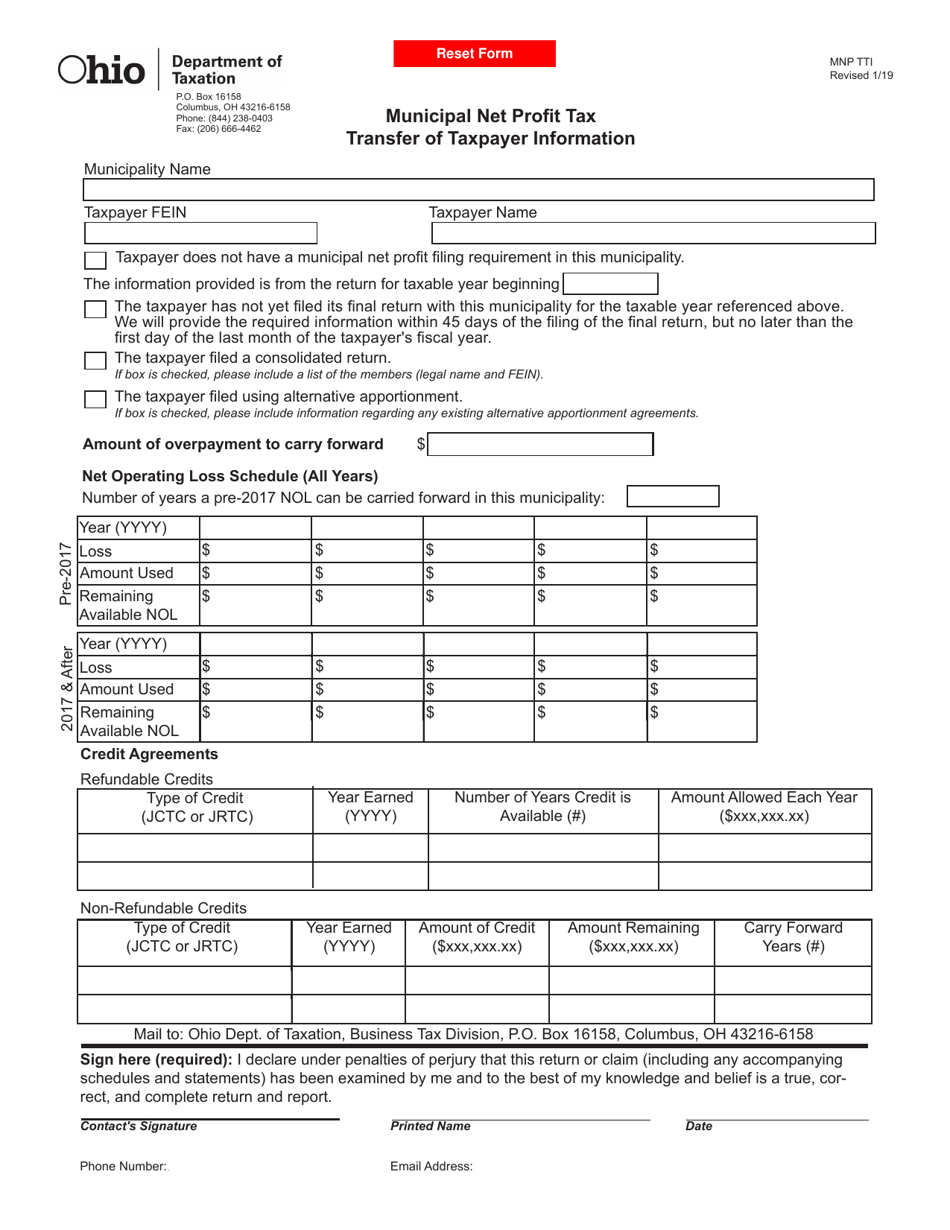

Form Mnp Tti Download Fillable Pdf Or Fill Online Municipal Net Profit Tax Transfer Of Taxpayer Information Ohio Templateroller

Ohio Department Of Taxation Home Facebook

Https Tax Ohio Gov Portals 0 Muni Net Profit Instructionsfordeclarationofestimatedpayments Pdf

Https Cdn Ritaohio Com Media 700762 Greater 20ohio 20association 20of 20tax 20administrators 20post 20on 20website 202019 Pdf

Https Cdn Ritaohio Com Media 701055 Pdf 20tax 20preparer 20webcast 202020 Post 20on 20website Pdf

Ohio Mnp 10 Tax Ohio Gov Ohio Mnp 10 Tax Ohio Gov Pdf Pdf4pro

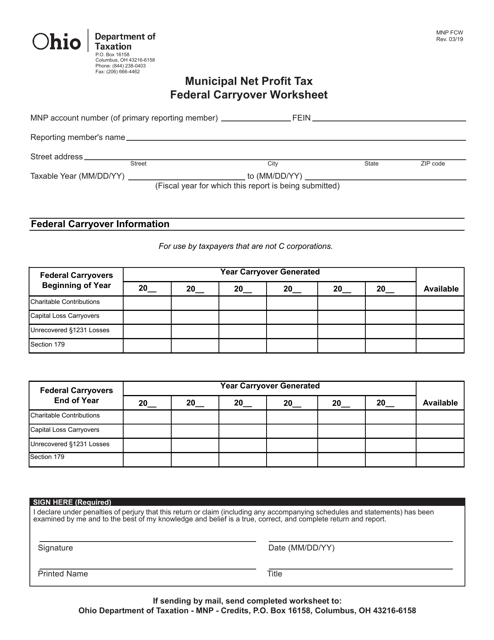

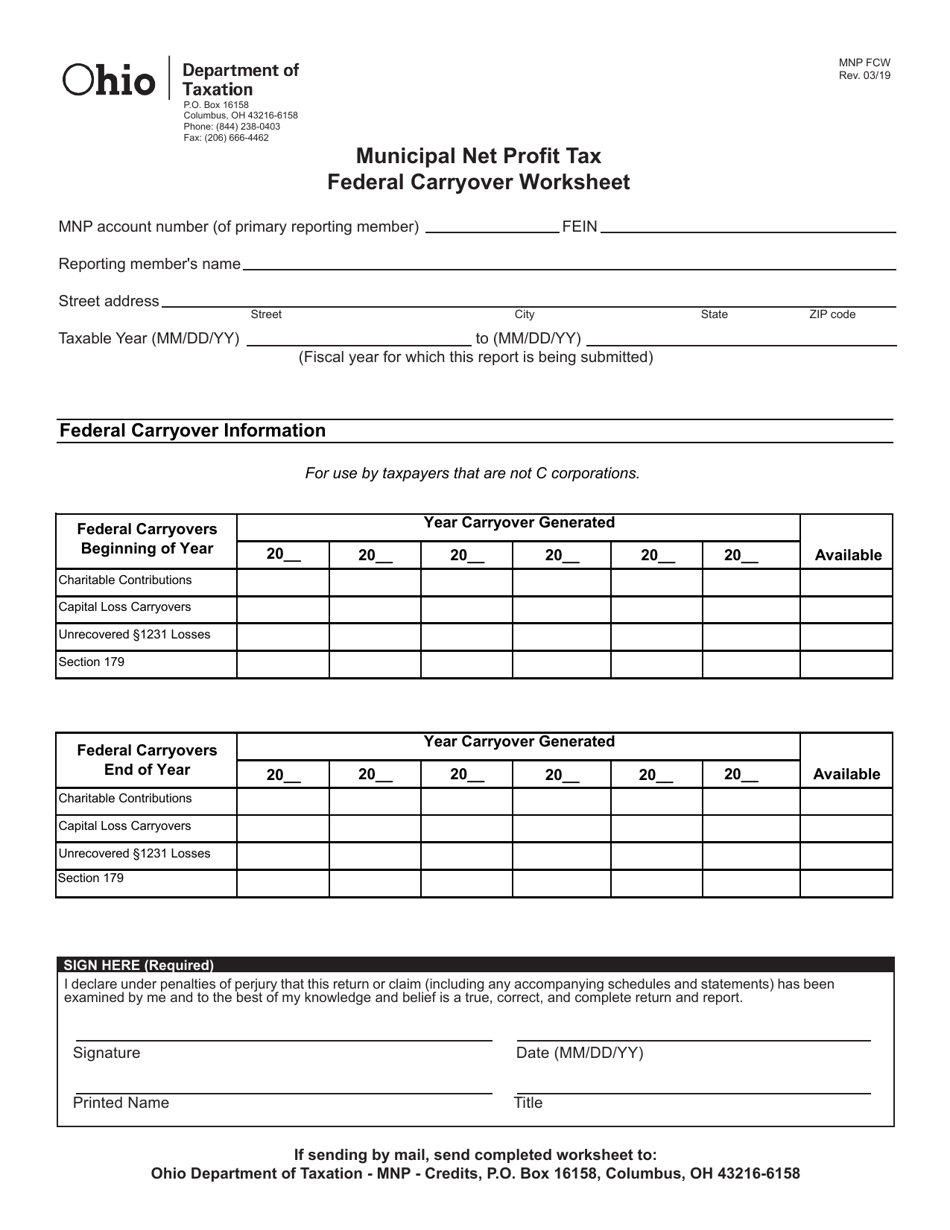

Form Mnp Fcw Download Printable Pdf Or Fill Online Municipal Net Profit Tax Federal Carryover Worksheet Ohio Templateroller

Form Mnp Fcw Download Printable Pdf Or Fill Online Municipal Net Profit Tax Federal Carryover Worksheet Ohio Templateroller

Ohio Mnp 10 Tax Ohio Gov Ohio Mnp 10 Tax Ohio Gov Pdf Pdf4pro

Ohio Tax Gateway Ohio Business Gateway Sales Tax

Form Mnp Tti Download Fillable Pdf Or Fill Online Municipal Net Profit Tax Transfer Of Taxpayer Information Ohio Templateroller

Municipal Net Profit Taxpayers Department Of Taxation

Form Mnp Tti Download Fillable Pdf Or Fill Online Municipal Net Profit Tax Transfer Of Taxpayer Information Ohio Templateroller

Https Cdn Ritaohio Com Media 701055 Pdf 20tax 20preparer 20webcast 202020 Post 20on 20website Pdf

Municipal Net Profit Tax Department Of Taxation

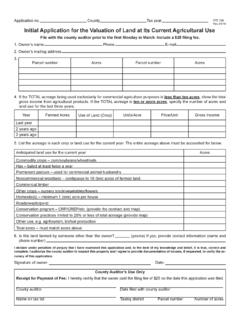

Form Mnp Nol Dw Download Fillable Pdf Or Fill Online Municipal Net Profit Tax Net Operating Loss Deduction Worksheet Ohio Templateroller

Https Tax Ohio Gov Portals 0 Ohiotaxalert Archivedalerts Regmuninetpro Pdf

Https Tax Ohio Gov Static Ohiotaxalert Archivedalerts Registration Mnpt 21921 Pdf

Post a Comment for "Ohio Municipal Net Profit Tax Rates"