Private Company Valuation Ebitda Multiple

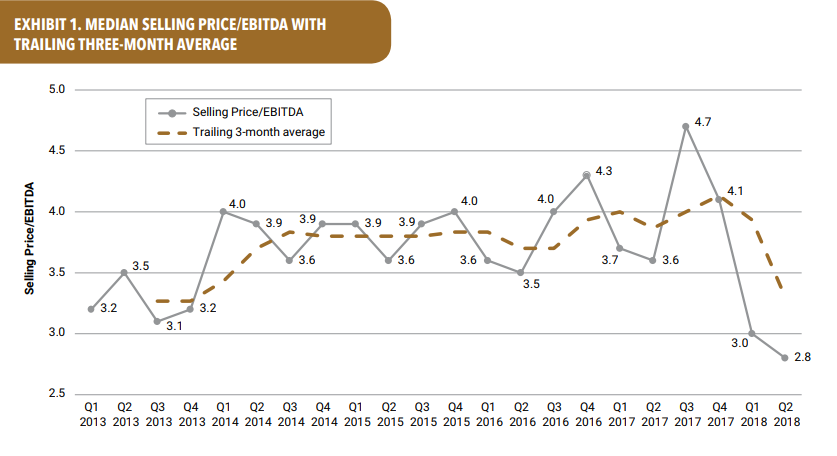

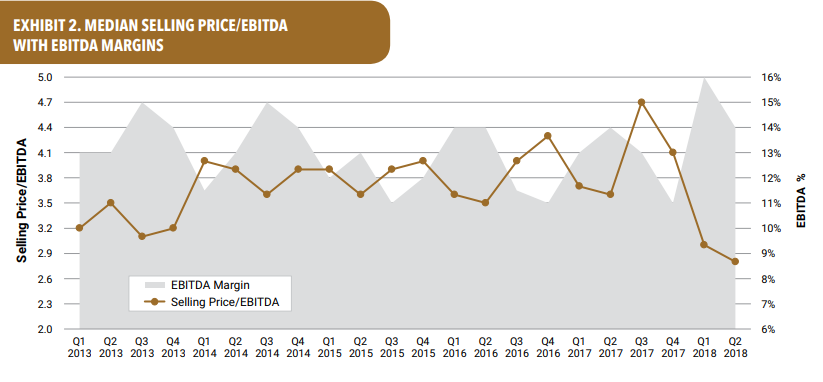

Where do you Stop. Selling price divided by EBITDA earnings before interest taxes depreciation and amortization is a commonly used valuation multiple.

Middle Market Private Equity M A Activity Q1 2020

For early stage companies it is quite often a multiple of revenues because either they are not profitable or they are in a high growth phase.

Private company valuation ebitda multiple. 198 rows Valuation Multiples by Industry. VRC is widely respected for its depth of industry knowledge technical skill and responsiveness to each clients unique needs. Our valuation professionals are deeply involved with clients to understand their industry and the nature of their business.

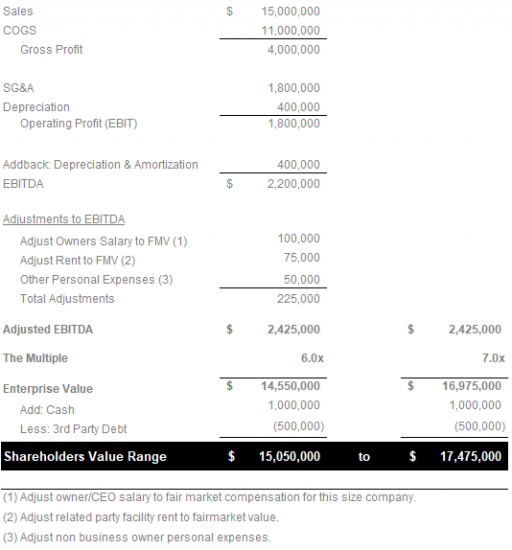

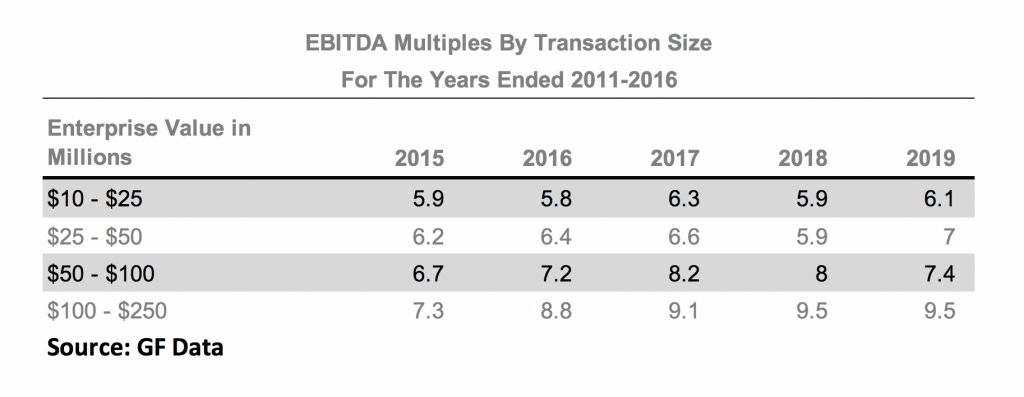

What is the right EBITDA multiple for my business. In general any business with an EBITDA somewhere between the one million and ten million dollar range will enjoy an EBITDA multiple anywhere between 40 time to 65 times. Business Valuation Resources recently published EBITDA multiples by industry from a study of over 30000 sold private companies listed in the DealStats database.

Lets suppose that a business is initially worth 5M. Valuation Multiples for Any Industry Valuation Research. Private company ebitda multiples.

Needless to say these numbers are extremely generic and plenty of industries have a. What advice can you offer on the topic of selecting a valuation professional. Why is independence such an important factor when hiring a.

221 rows In order to achieve this youll need to know your exit multiple. June 3 2021 1 min read. The first approach is called multiples and requires we first identify sensible comparable companies with public data and can serve as a reasonable proxy for our underlying firm or project.

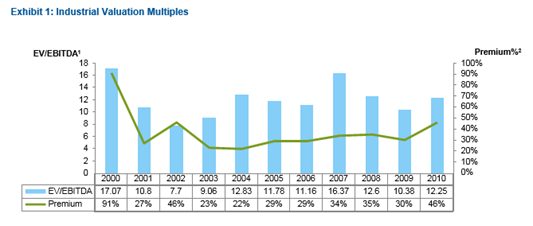

A valuation approach commonly used by private equity and investment banking professionals and the one we will discuss herein applies a multiple the Multiple or Multiple to Earnings Before Interest Taxes Depreciation and Amortization EBITDA. Multiples used to value many businesses exceeding six times EBITDA are less common. Multiple ranges vary and the size internal dynamics and strategic plans of the acquirer.

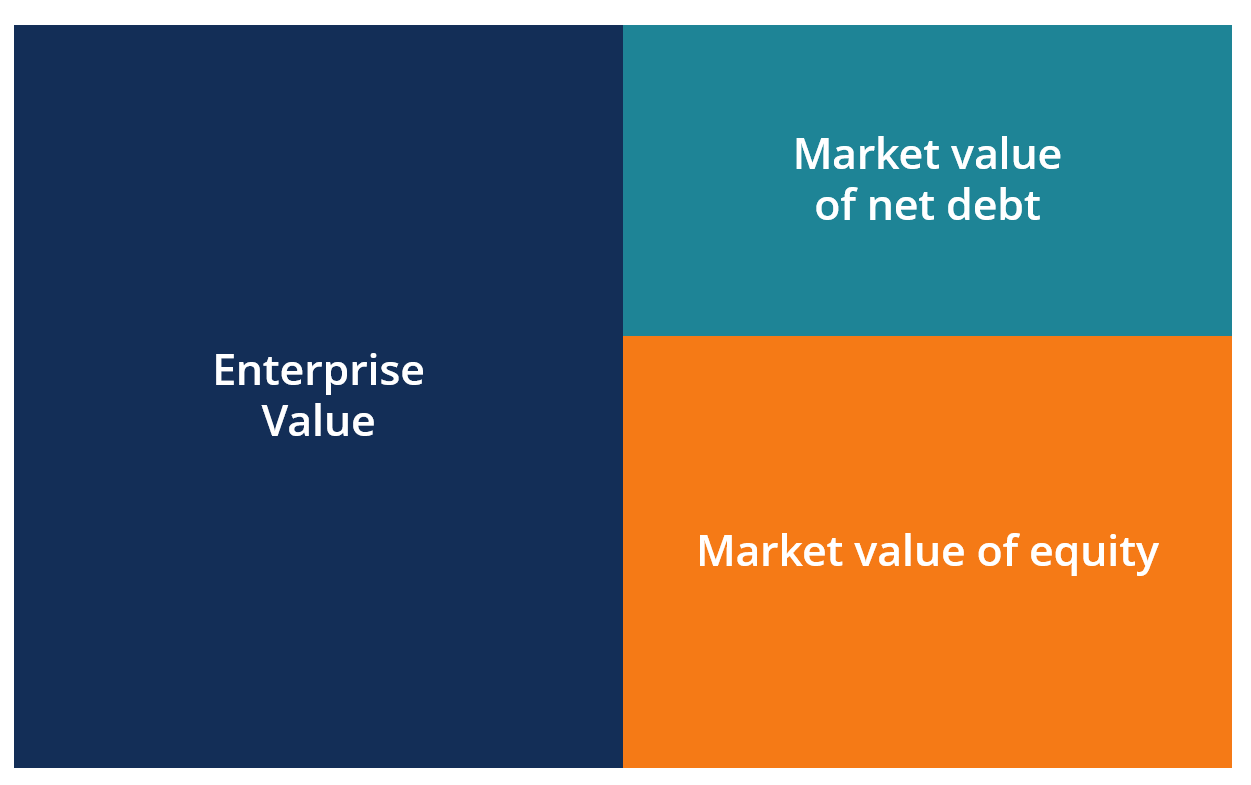

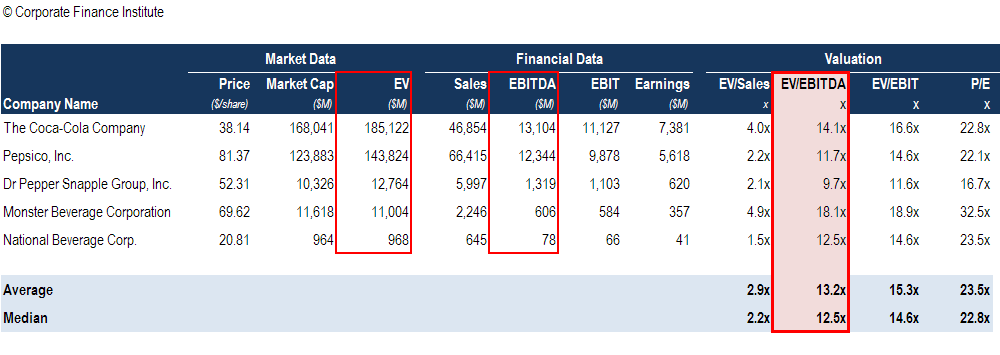

Lets dive into the highlights from the analysis. Known proxy enterprise values are converted into multiples of EBITDA and extrapolated to value the private company or project of interest. For public companies the most cited valuation multiple is the after tax net income multiple the price-earnings multiple or PE multiple.

Weve performed valuations of. For additional insights on private company deals download BVRs 3Q2018 DealStats Value Index Brief. Do I need a fairness opinion if I buy or sell a company.

The table below summarises eVals current month-end. Given the facts the post-money valuation of the company is 20M 10M 50 while the pre-money valuation is 10M 20M x 50. Private company ebitda multiples.

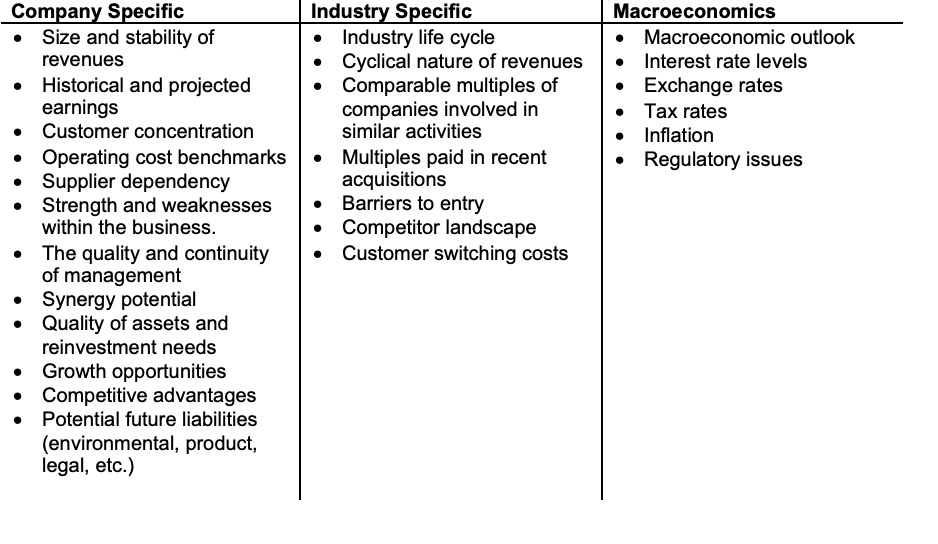

How do I specify the value of my companys stock in a buy-sell agreement. 221 rows Multiples reflect the average price of a company when compared to a. The EBITDA multiple applied to a particular private business is a function of a potential buyers view of its risk-return profile.

The majority of businesses generating between 10 million and 75 million of annual revenue historically transact for EBITDA multiples between 50x and 80x EBITDA. Key income statement multiples of EBITDA EBIT are compared and these multiples are then applied to the target company. Comparable Analysis Private Company This is a common market approach to value the company by examining previous acquisitions transactions of similar target companies.

The investor can make greater returns in much less risky investments. After a successful launch a potential investor is willing to invest 10M for a 50 stake.

Ebitda Multiple For Business Valuation Magnimetrics

How To Estimate The Value Of A Private Company What Is My Business Worth

Multiples The Market Approach To Valuation Chinook Capital

Ebitda Multiples By Industry New Statistics On Private Company Selling Prices Business Valuation Resources

How To Value A Private Company Clearlight Partners

Are Acquisition Multiples Too High

How To Calculate The Enterprise Value Of A Private Company Development Corporate

Enterprise Value Ev Formula Definition And Examples Of Ev

Ebitda Multiples By Industry New Statistics On Private Company Selling Prices Business Valuation Resources

Ebitda Multiple Valuation For Determining Enterprise Value

/FS_AM_Valuation-Methodologies_Pt2_7-20_table3.jpg.aspx)

Demystifying Valuation Methodologies Part Two July 2020

Seven Critical Business Valuation Factors Mcm Capital

Ebitda Multiple For Business Valuation Magnimetrics

Ebitda Multiple For Business Valuation Magnimetrics

Ebitda Multiple Formula Calculator And Use In Valuation

Private Equity Deal Value Rises In A Crowded Market

Formula For Success Uncovering How Private Markets Managers Create Value For Investors Fi3 Advisors

Business Valuation Multiples At Record Highs Saybrook Capital Advisors

Ev Ebitda Of Private Equity Exits In Emea By Industry 2019 Statista

Post a Comment for "Private Company Valuation Ebitda Multiple"