How To Value A Company Formula

Apply the formula to the previous example when the software development teams completion rate is 375 and the project budget is 200000. Hire a Business Broker.

What Is Loan To Value Ltv Ratio How To Calculate Ltv Formula Loan Calculator Investing

Calculating book value the place to start when calculating the book value of a company is that companys balance sheet.

How to value a company formula. Prepare for a Sale. The result is your earned value. Earned value of completion x project budget Earned value 375 x project budget Earned value 375 x 200000 0375 x 200000 75000.

For example if your companys adjusted net profit is 100000 per year and you use a multiple like 4 then the value of the business will be calculated as 4 x 100000 400000. How to value private companies. In profit multiplier the value of the business is calculated by multiplying its profit.

3 Tips For Buyers. Price to book value ratio denotes how expensive the stock has become. Ask for Seller Financing.

Look Beyond the Past Provide Projections. There are many ways to calculate the value of of a company. Determining the value of a business for sale is complex and there are many ways a business can be valued.

Take Emotion out of the Business Valuation Process. Add the total value of your net liquid assets to the figure you calculated in step 2. If Only It Were That Simple You may have noticed that much of what constitutes valuation is based on what you think.

You will learn how to use the dcf formula to estimate the value of a company. If you have net liquid assets of 75000 the total value of your business is 225000. While you may pay more for a business in an industry with high multiples its also more likely to hold its value.

A companys total variable cost is the expenses that change in relation to the total production during a given time period. Annual earnings before interest taxes depreciation and amortization Anticipated rate of earningscompensation growth 0 if level 0 to 100 Number of years earnings are expected to continue. Maximum 10 which assumes perpetuity 0 to 10 Level of businessindustryfinancial risk.

Review Improve Your Promotion Strategy. 7 Tips to Maximize Your Business Valuation. Find an Industry with Potential.

Like a bond that pays interest choose how much you would. Decide If You Need Professional Assistance.

What Your Wares Are Worth Easy Formula Things To Sell Craft Business Business Tips

How To Find Intrinsic Value Of Stocks Using Graham Formula Investment Quotes Stock Market Basics Finance Investing

Pmp Formulas And Calculations The Complete Guide Project Management Templates Program Management Project Management

Enterprise Value Formula Equity Value Formula Calculator Excel Template Enterprise Value Equity Capital Market

Annuity Contract For Cash Inflows Outflows Example Calculations Annuity Finance Quotes Annuity Formula

Estimate To Complete Earned Value Management Management Estimate

7 Business Valuation Methods You Should Know Business Valuation Structured Finance Debt Solutions

The Hard Truth About Business Model Innovation Business Analysis Business Studies Innovation

Estimate At Completion Formula Earned Value Management Management Formula

How To Find Intrinsic Value Of Stocks Using Graham Formula Graham Formula Is A Fast Simple And In 2020 Intrinsic Value Fundamental Analysis Stock Market Investing

Estimate At Completion Formula Earned Value Management Formula Pmp Exam

Time Value Of Money Financial Mathematics Icezen Time Value Of Money Accounting And Finance Finance

Annuity Formula Annuity Formula Annuity Maths Solutions

Pert Formula Earned Value Management Formula Pmbok

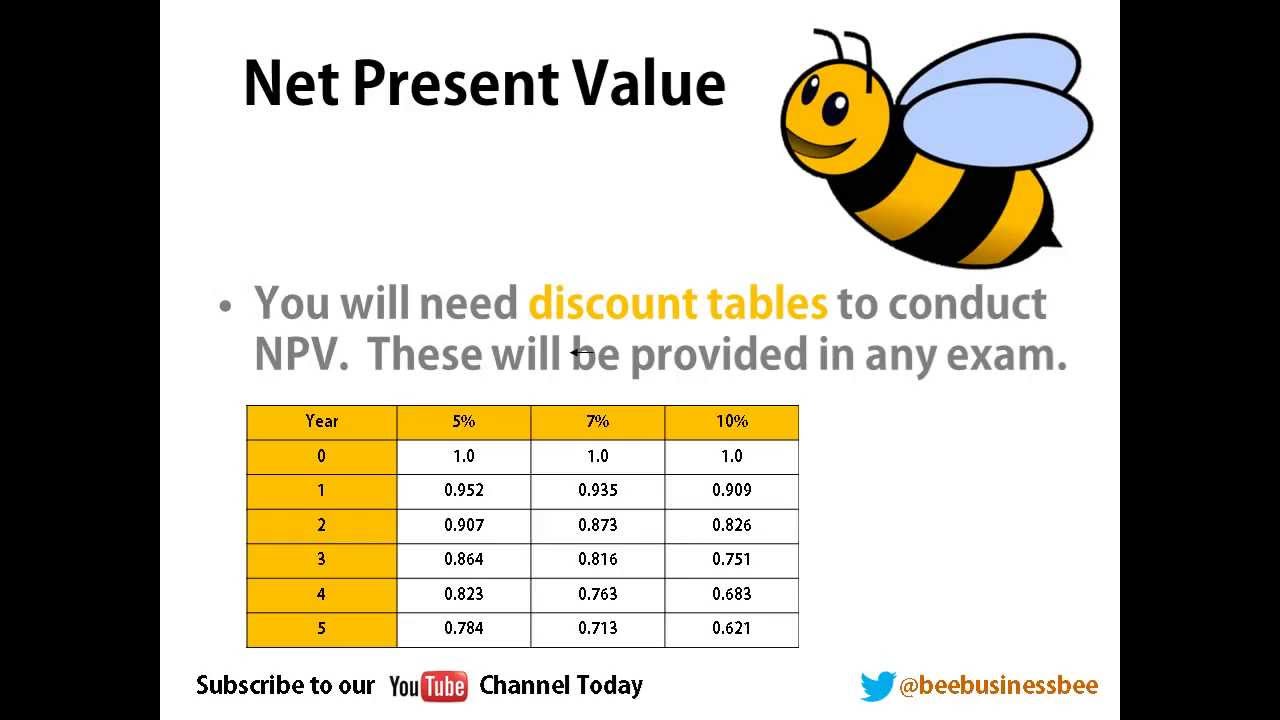

Bee Business Bee Investment Appraisal Net Present Value Npv Investing Appraisal Business

Analyse The True Value Of Your Company With The Help Of Market To Book Ratio To Find The Value Of A Firm To Its Market We Use Market Marketing Books Finance

Return On Net Assets Formula Examples How To Calculate Rona Valuing A Business Time Value Of Money Asset

Standard Deviation Formula Standard Deviation Earned Value Management This Or That Questions

Financial Literacy Understanding Calculating Compound Interest Personal Finance Compound Interest Math Money Management Advice Finance

Post a Comment for "How To Value A Company Formula"